Within Elorus you can track both incoming and outgoing cheques and create related payments, linked to invoices and bills.

Cheques are divided into Incoming (when given to you by the client) and Outgoing (when you give it to a supplier).

To add and manage both incoming and outgoing cheques, go to the main menu and click Settings > Add-ons > Install to enable this feature.

For more information about Add-ons, please visit the related page.

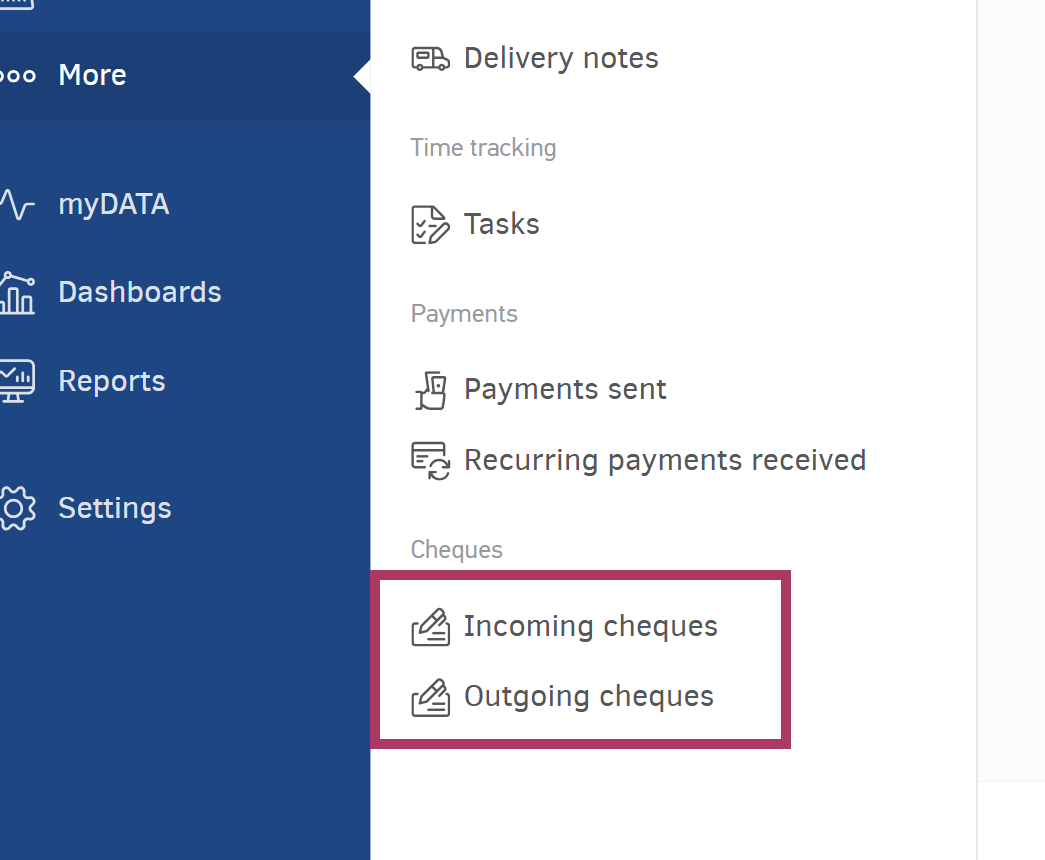

Once enabled, navigate to ...More > Incoming cheques & Outgoing cheques to add and manage such records.

When adding a new check, the mandatory fields are:

- Issue date

- Due date

- Amount

- Contact

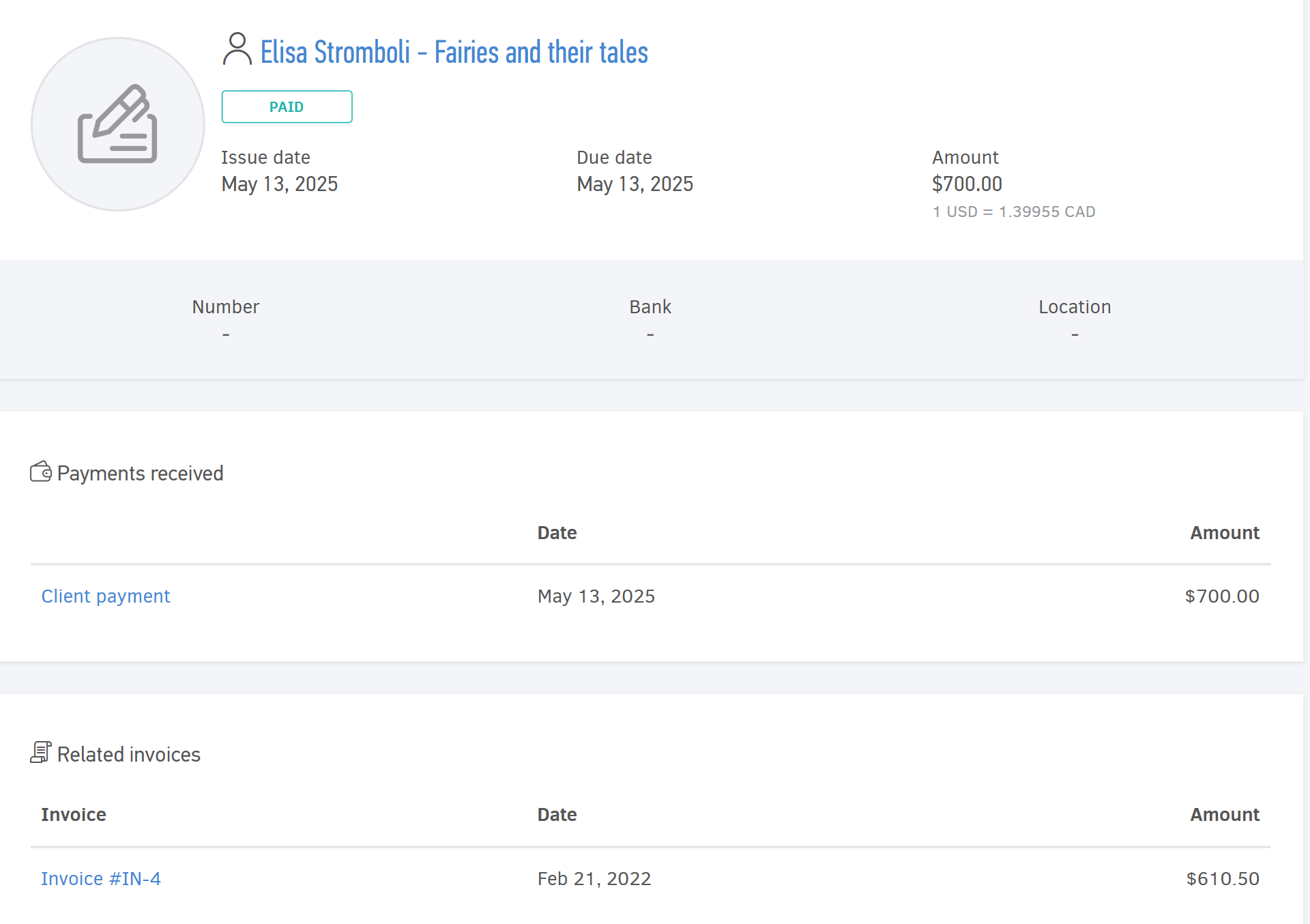

You can fill in additional info, such as the cheque's number, bank and location.

Any cheque (outgoing or incoming) must always be associated with a document of the same currency. Also, the exchange rate of the cheque is "locked" to the suggested exchange rate you set on the date of issue. For more information on multiple currencies and exchange rates, please visit this article.

You can always monitor the status of your cheque and edit it in case it is canceled, paid, or bounced.

When a cheque associated with one or more invoices is Paid, the corresponding cash flow transactions (Payments received or Payments sent) will be automatically created.

To mark a cheque as Paid, you need to open it and click Edit. Change the due date to the current one and set the status to Paid.

Elorus will attempt to pay off the client's or supplier's outstanding invoices, starting off with those with the oldest issue date. This means that invoices that were issued earlier are the ones that are paid first.

If the cheque amount is greater than the total value of the invoices, then an excess amount will be created, which can be used for future payments.