Except for VAT/GST taxes and Withholding taxes, Elorus allows users to create custom taxes. Unlike other tax types, simple taxes offer additional configuration options.

These taxes can be applied either as line taxes or as a global tax on the document total.

To add a simple tax, go to the main menu and select Settings > Taxes > Add, then fill out the next fields.

Title

The title refers to the name of the tax and determines how it will appear on invoices and other sections of the application.

If you want to save the title in a different language, click the Translations button. Elorus will detect the document's language based on the template used and automatically apply the appropriate translation.

Tax type

This field defines whether the tax is a simple tax, a VAT/GST tax or withholding tax.

If your tax is just a Simple tax, don't select VAT Withholding tax.

Tax value as

Specify whether the tax should be a Percentage, a Fixed amount or a Variable amount.

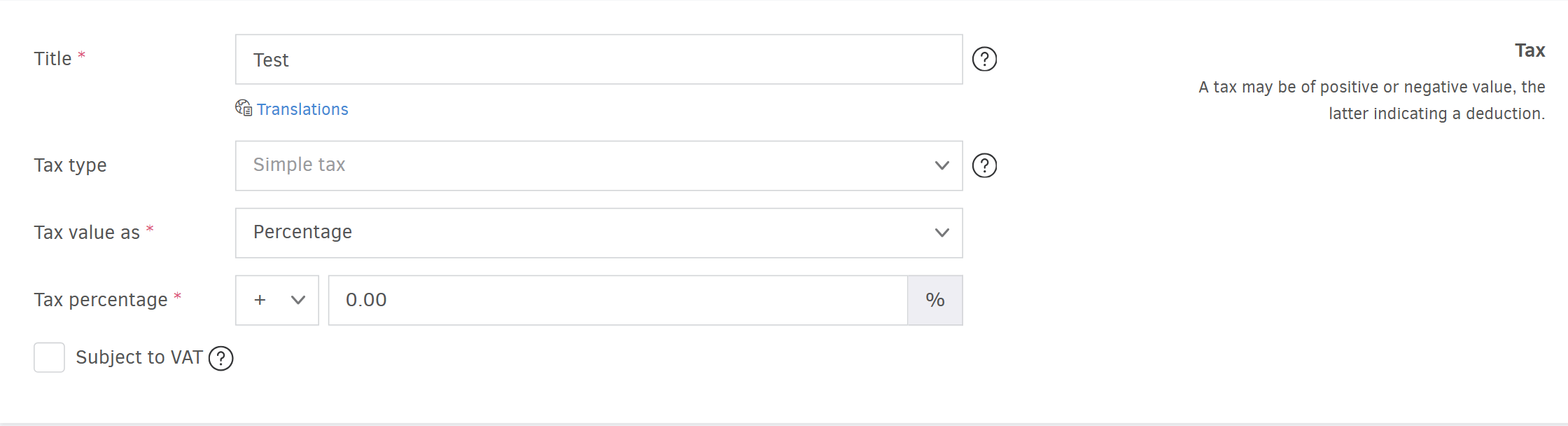

Tax percentage

Choose whether the tax value should be positive or negative, and define the percentage rate.

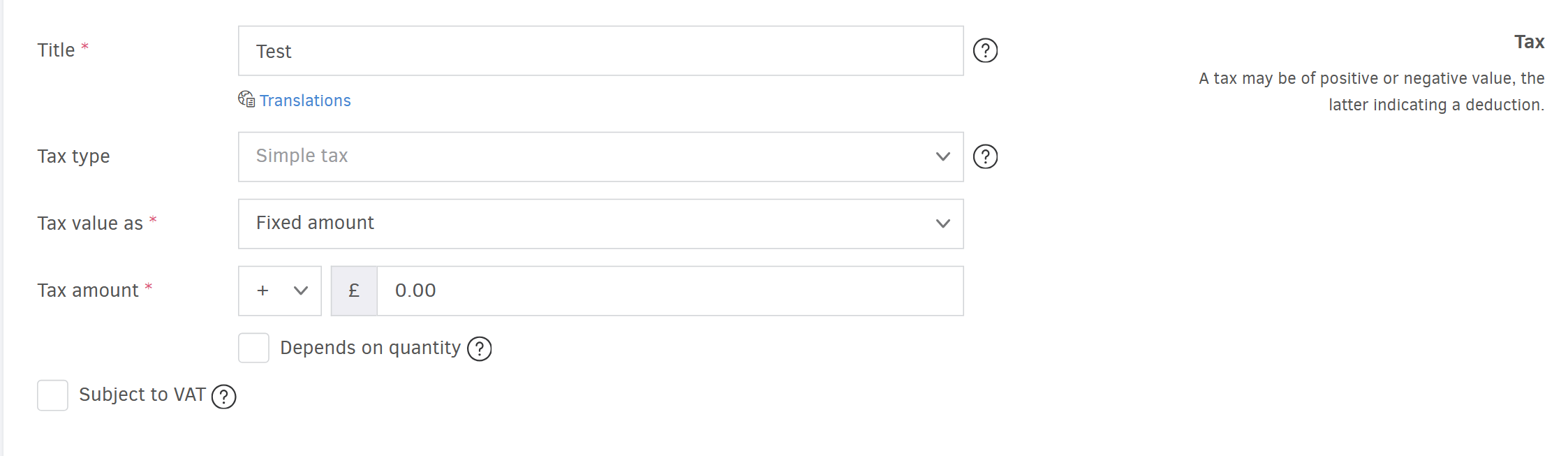

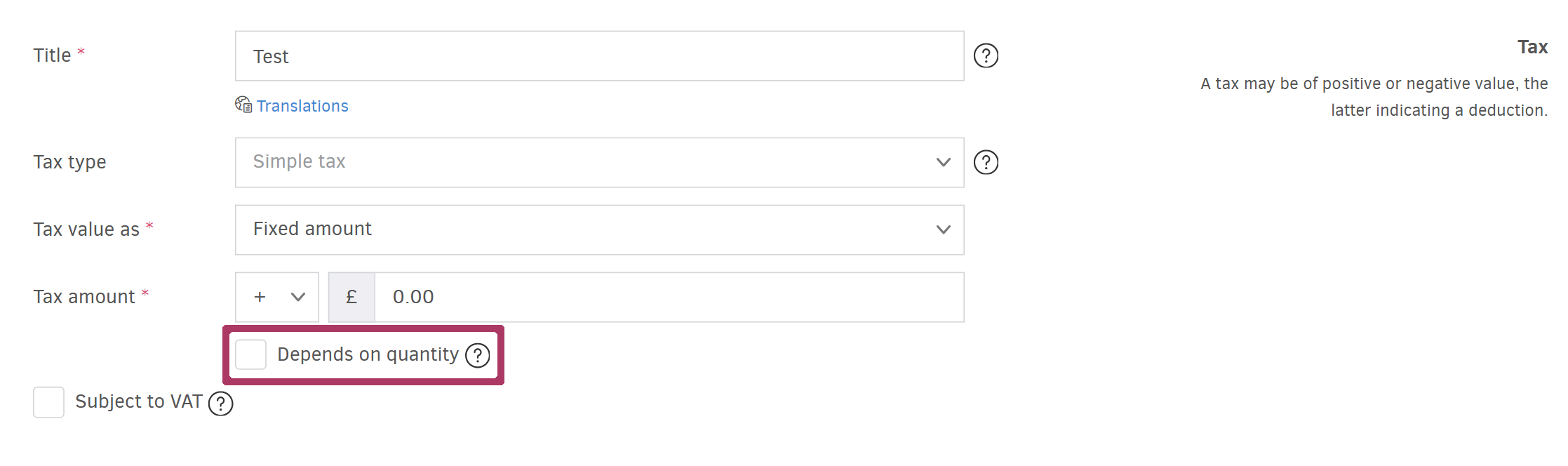

Fixed amount

Choose whether the tax value will be positive or negative, and set the fixed amount of the tax.

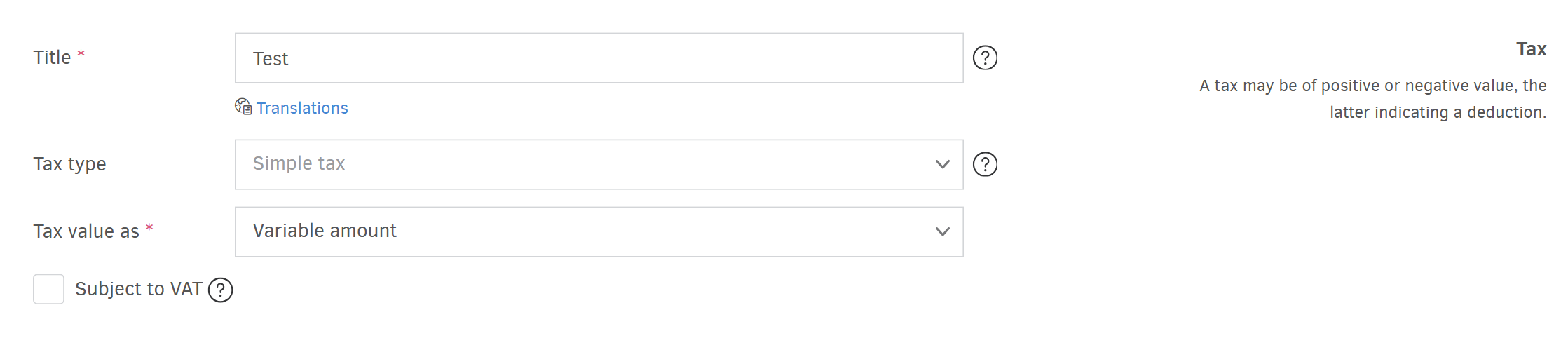

Variable amount

If you choose to calculate the tax as a variable amount, you’ll need to specify the value manually each time you issue an invoice, directly from the document creation form.

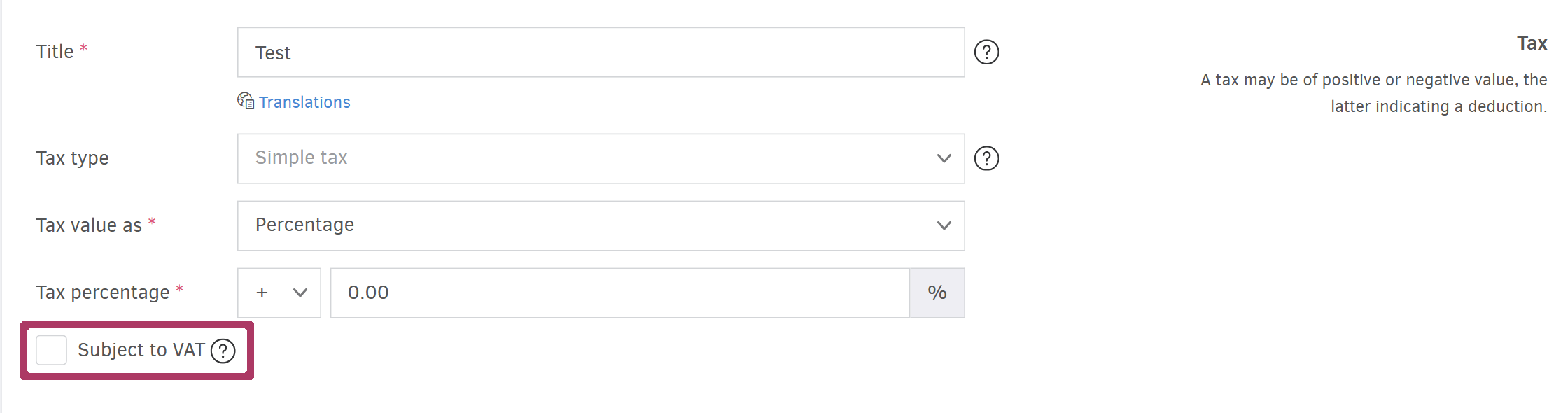

Subjected to VAT

By clicking on this option, VAT will be applied on top of this tax, when invoicing.

Depends on quantity

When you choose to calculate the tax as a Fixed amount or as Variable amount, the Depends on quantity field becomes available.

This option allows the total tax to be computed as the product of the fixed or variable amount multiplied by the invoice line's quantity.