After creating your Elorus organization, you will need to set up the VAT rates applicable to your business activity, based on your country's tax regulations.

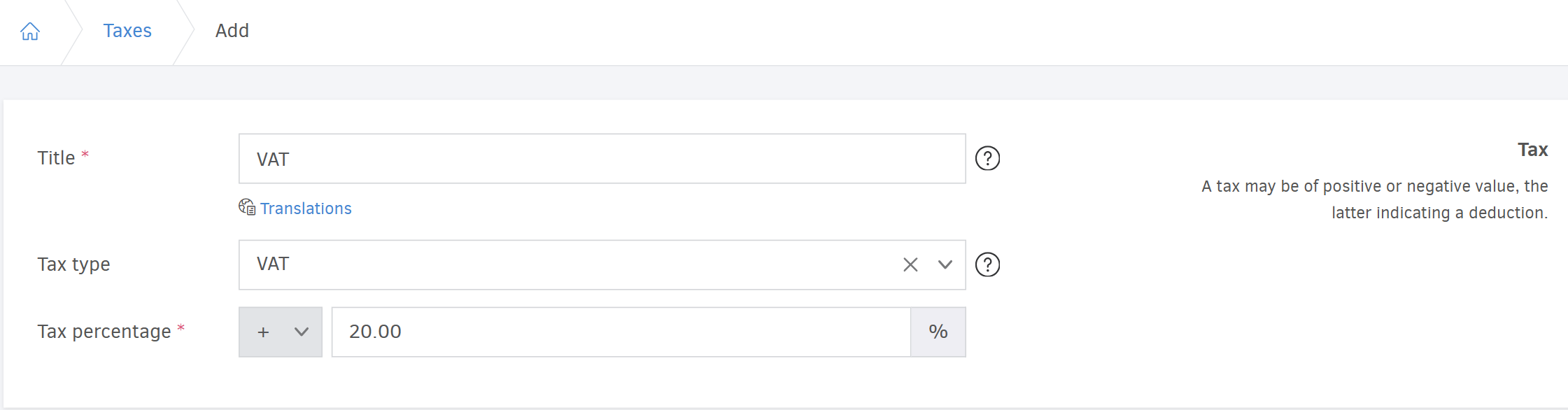

Το add a VAT tax, go to the main menu and select Settings > Taxes > Add, and then fill in the following fields.

Title

Enter the name of the tax. This will appear on invoices and other sections of the application.

If you want to save the title in a foreign language, click on the Translations field. Elorus will detect the language of the document based on the template used and automatically display the appropriate translation. These translations will be used on invoices, estimates, and other documents.

TAX type

This field determines whether this tax is a simple tax, a VAT tax or a withholding tax. In this case, you select VAT.

TAX percentage (%)

In this field, you set the percentage tax rate.

Save

Once you've completed all fields, press Save to save the tax in Elorus.