Register amounts owed to you to keep track on them through Elorus.

When moving to Elorus, you may need to transfer customer and supplier balances from previous transactions. One way to do this is to create all of your previous invoices and payments manually.

For instructions on the manual recording of previous invoices, refer to the related articles:

However, for brevity, you can follow the instructions below to record pending amounts from previous transactions.

Previous balances from customers

There are two possible scenarios: the customer owes you from unpaid invoices or your company owes a refund to them. The refund may be due to a return of goods, a pending credit note that has not been cashed out or overpayments made by your client (and exceed the amount due). The main concept is to create distinct entries from your regular sales documents (invoices and credit notes). To achieve this, you could create a new document type which “ties” your customers' previous balances.

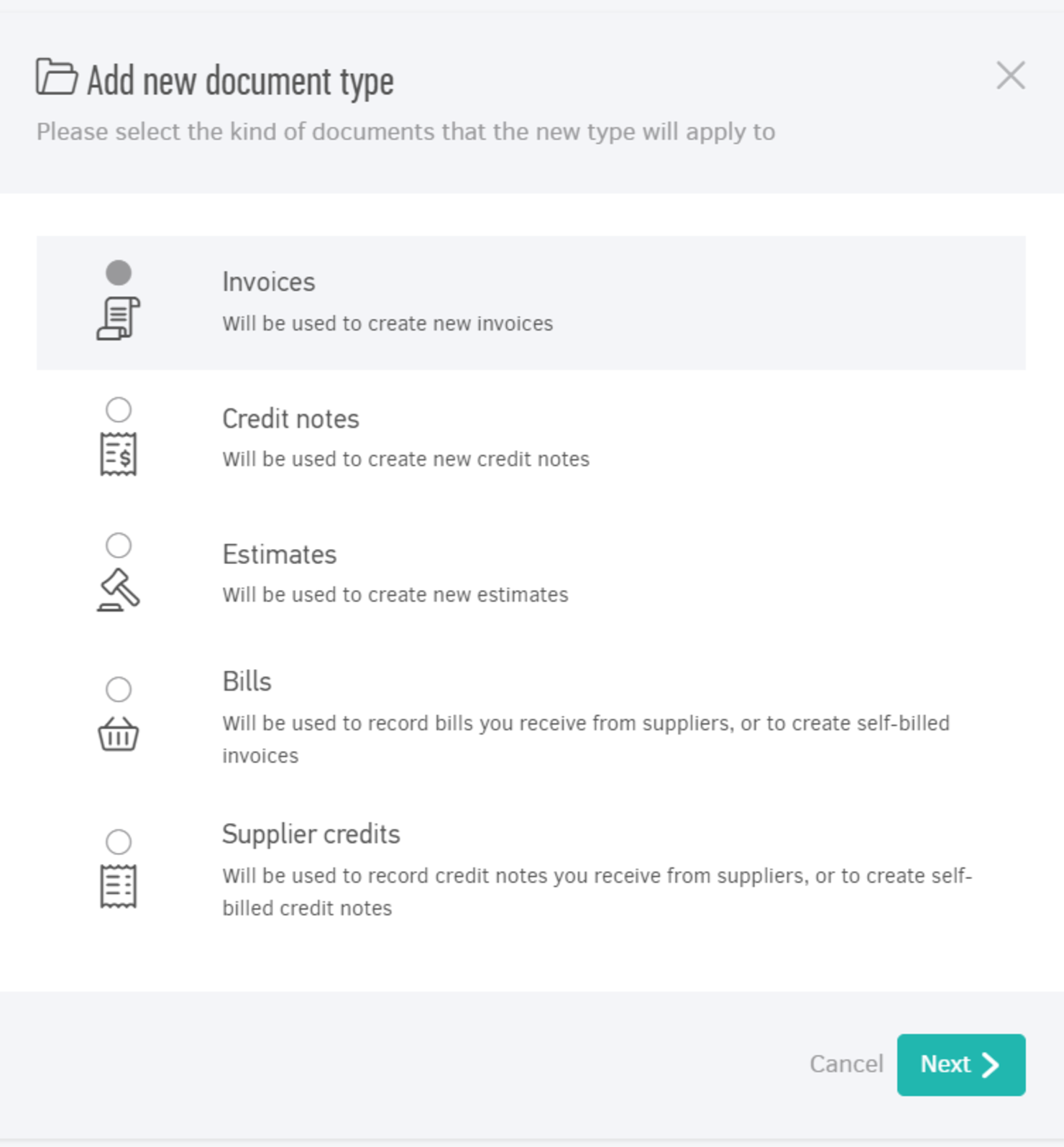

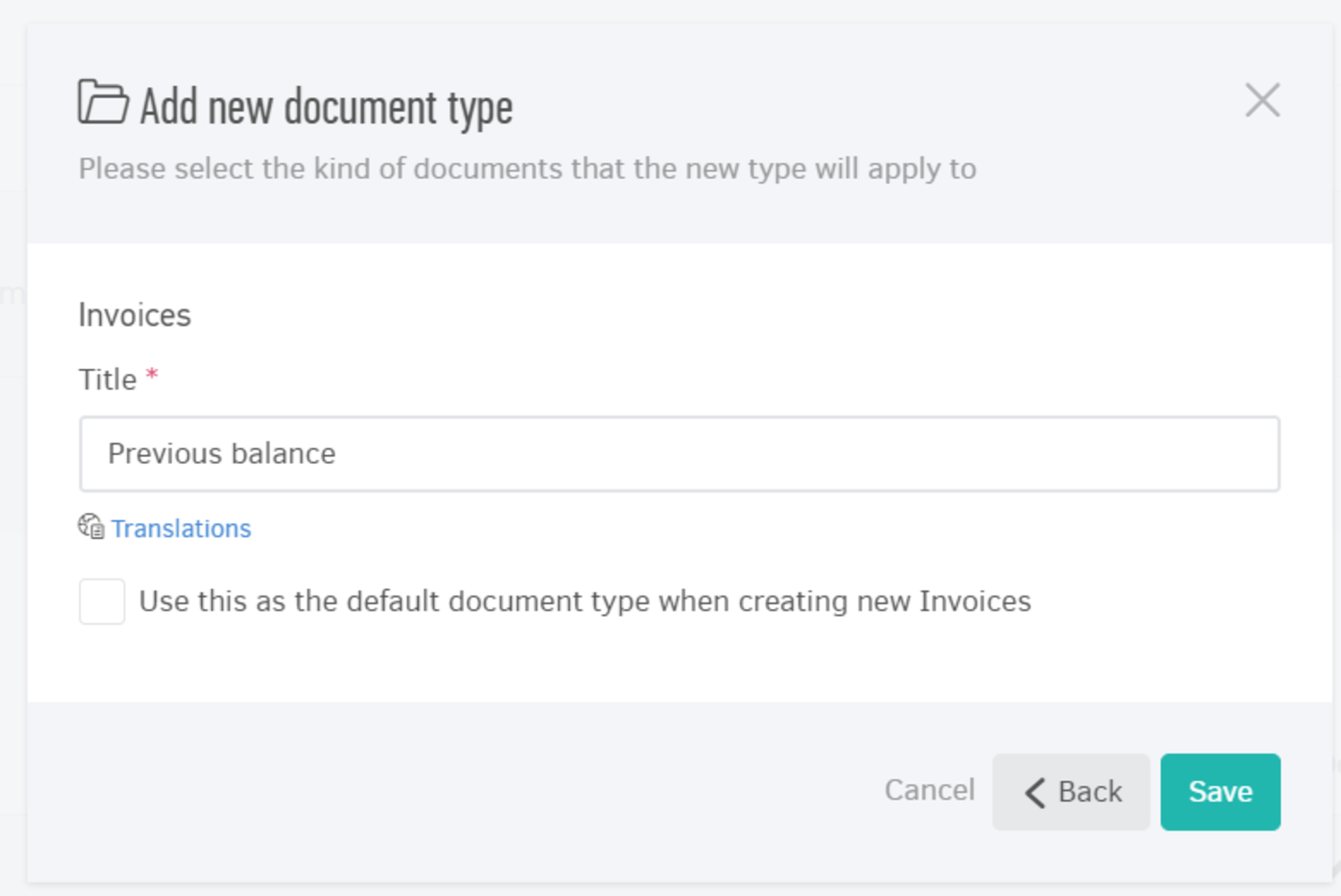

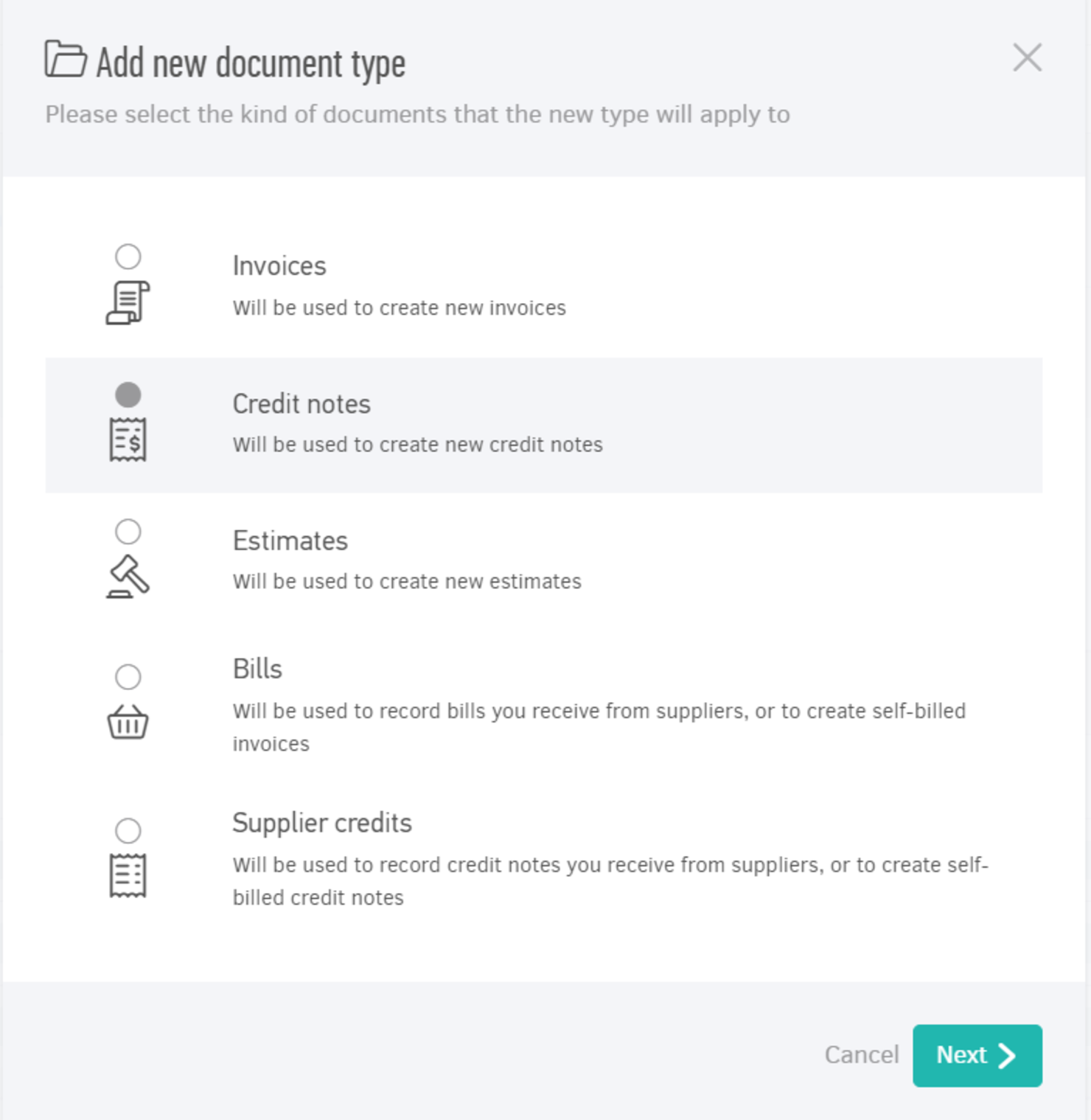

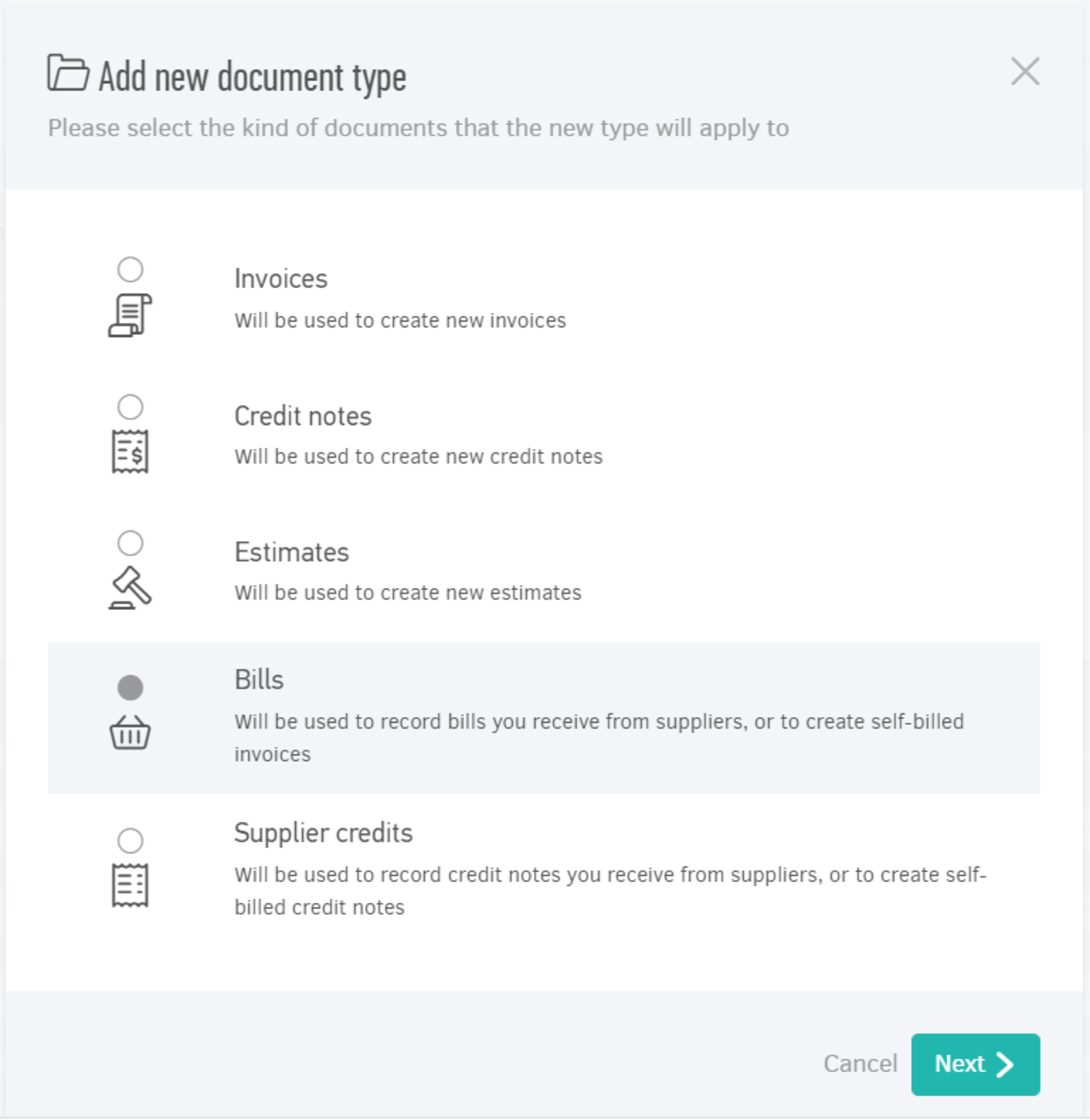

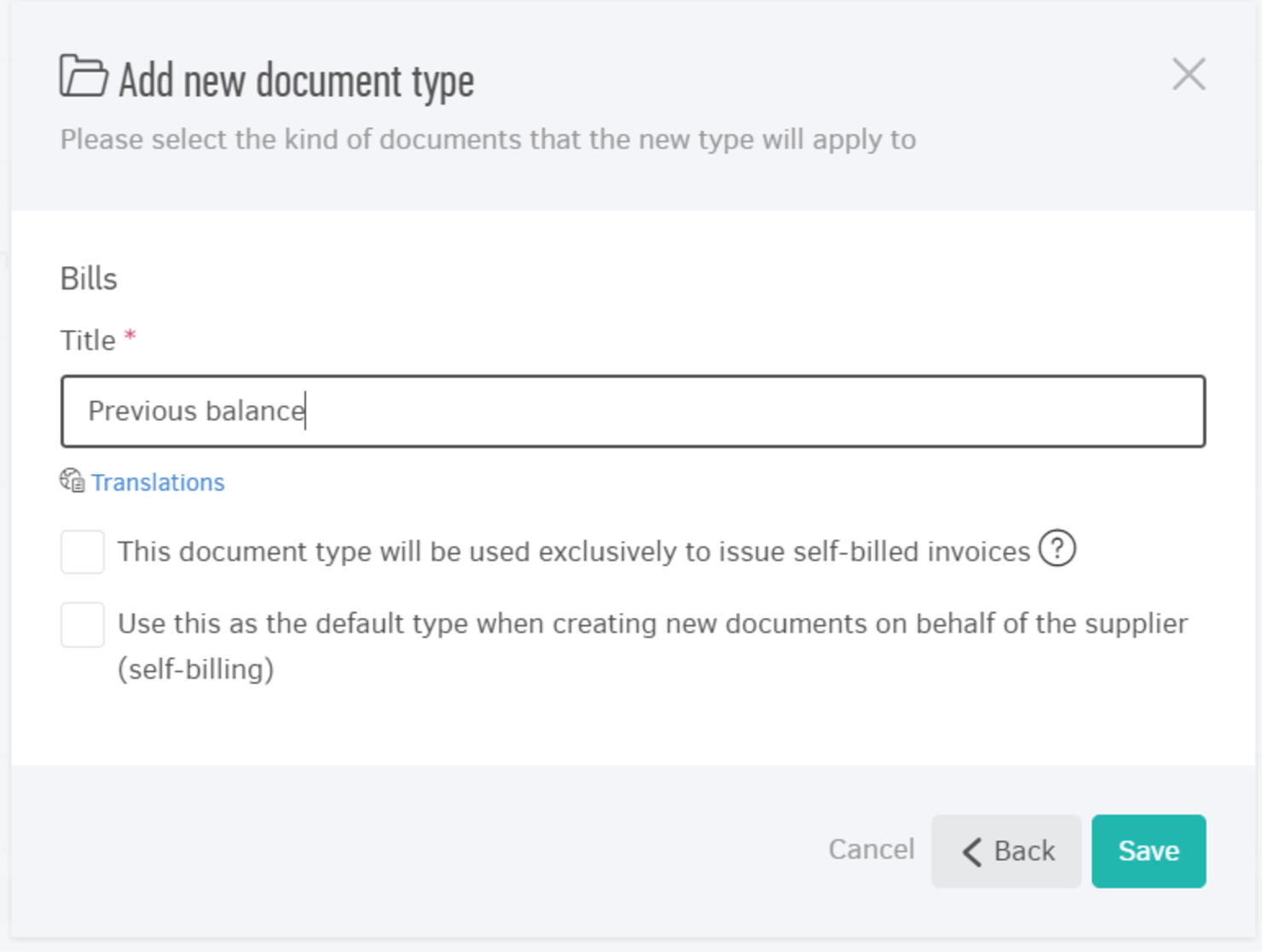

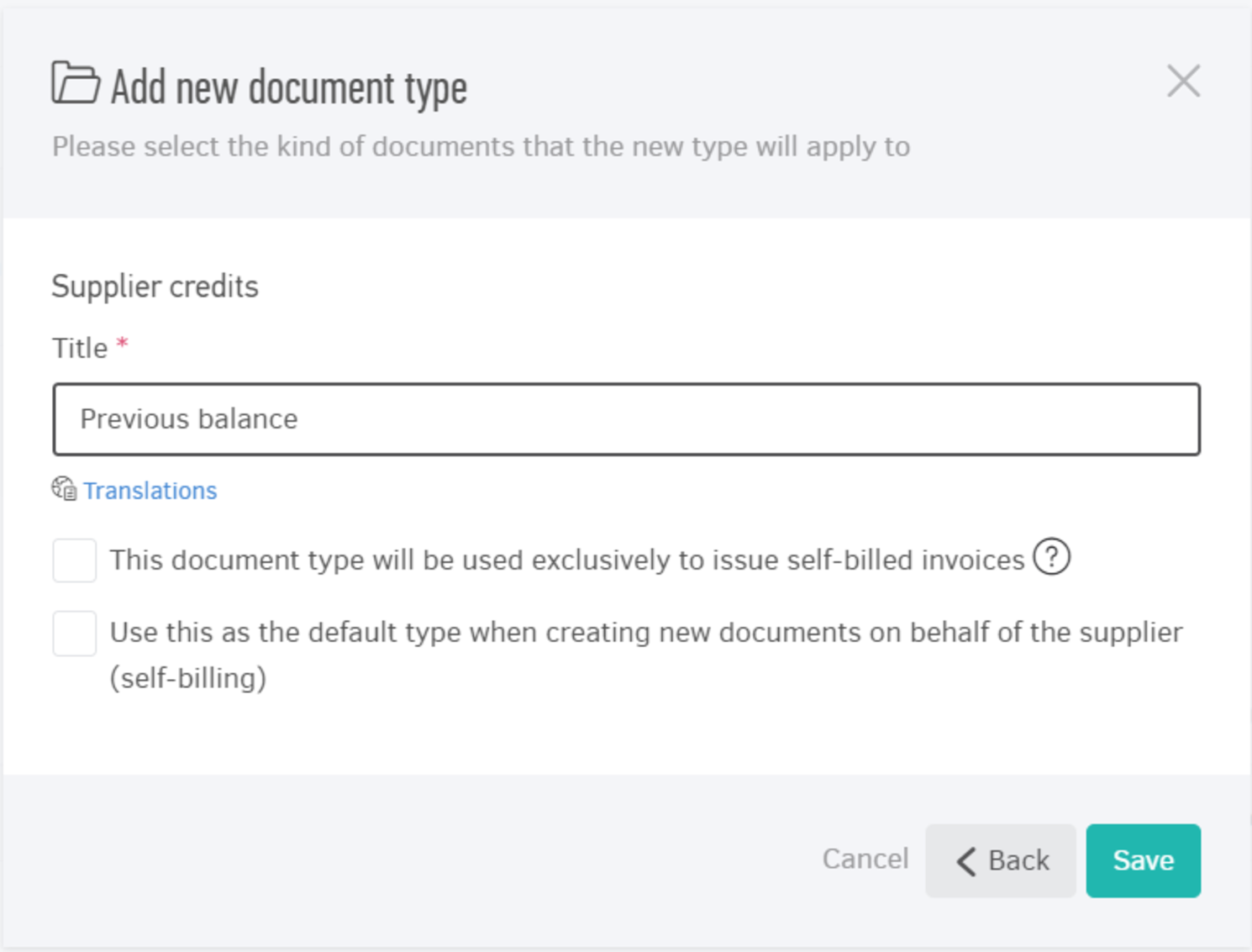

- Create the document type

From the Settings menu select "Document types-> Add". You choose the document type to apply to Invoices and then enter the title.

- The client owes your company

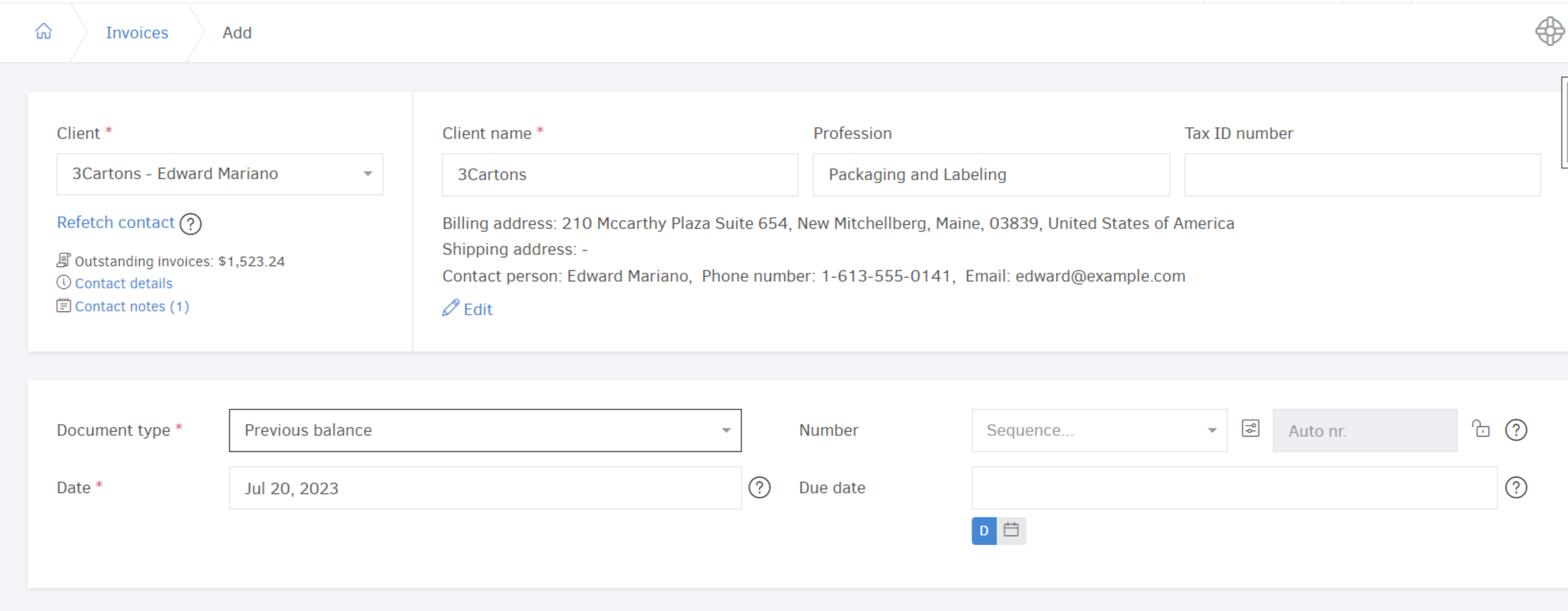

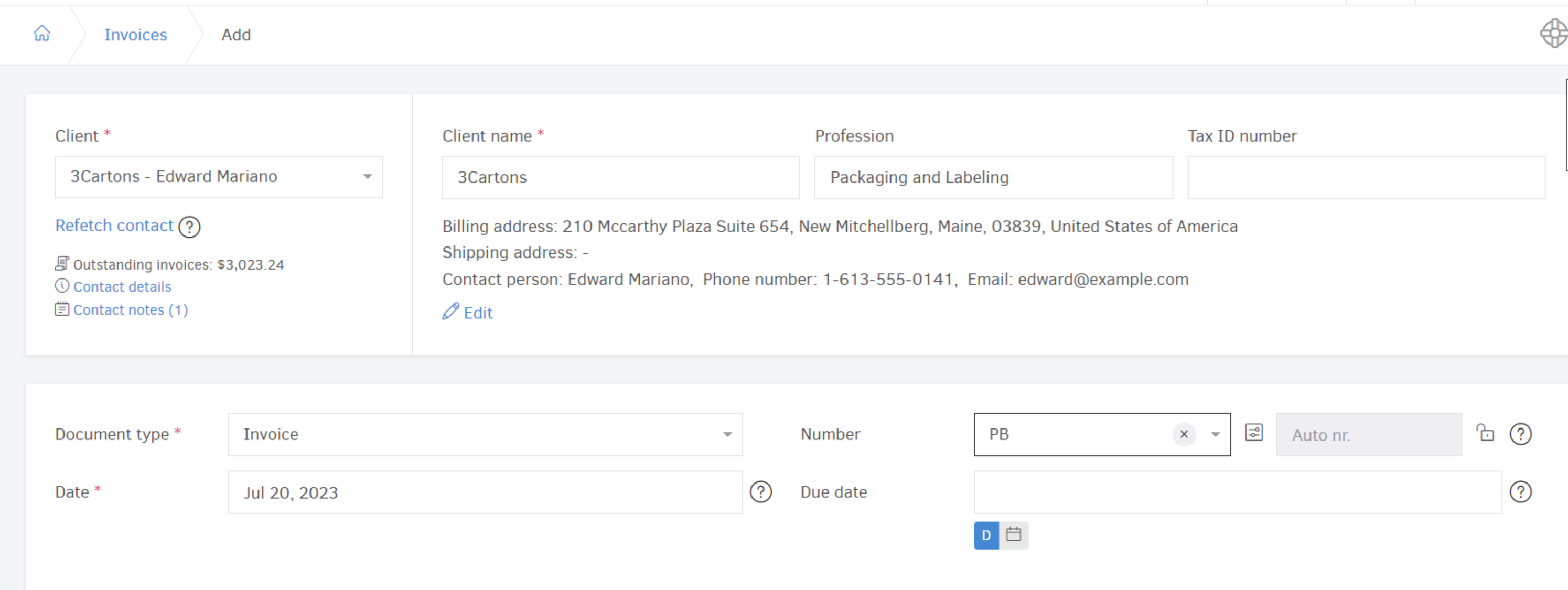

Once you create your document type you are ready to add invoices with previous balances to the contacts concerned.

Select "Invoices-> Add". After choosing the client from your list, you shall select "Previous balance" in the document type field (image below).

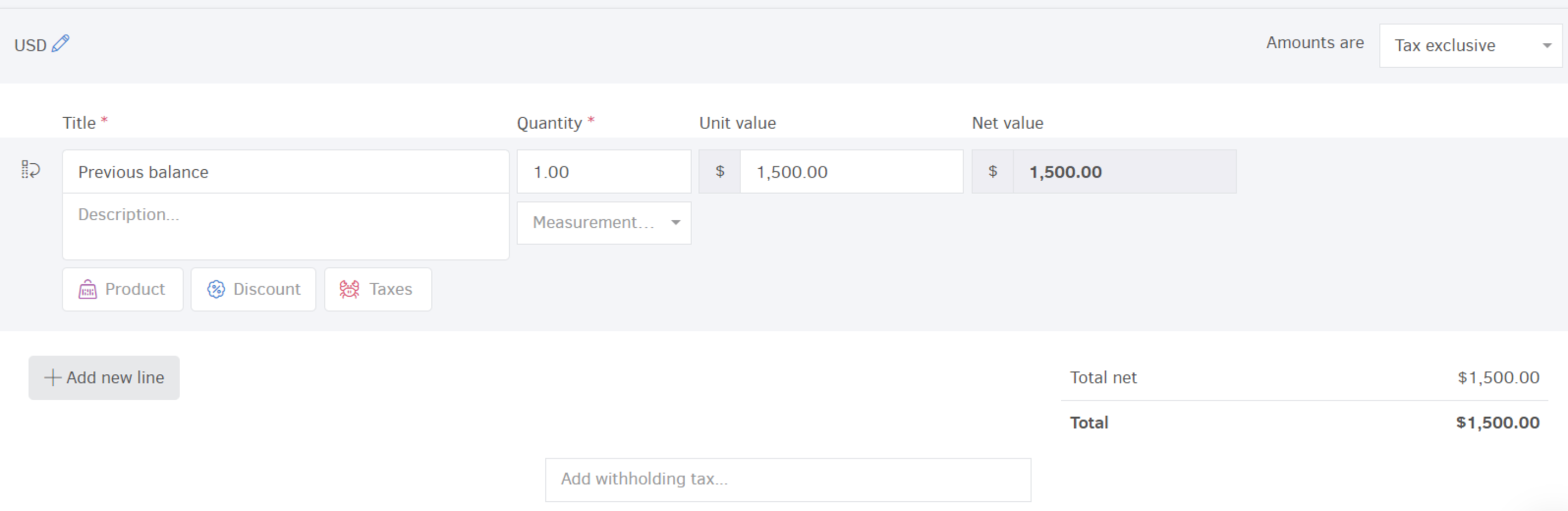

Next, in the "Products/Services" table and the "Title" field, you may enter a generic description of the transaction, such as Previous balance.

Then, you can enter the outstanding balance in the "Unit value", without applying any taxes from the respective field. Lastly, select "Mark as issued" and press "Save" to finalize the document.

After completing these steps, the client's previous balance will be visible inside the contact's details and statement.

Paying off previous balance

The outstanding balance can be paid off manually from the document's display page and the "Add payment" option, just like any other sales document. Also, the customer can pay this amount online through the client portal or by sending them the previous balance "document" via email. Refer to the related articles for more information:

- Your company owes to the client

The same applies when submitting a credit balance.

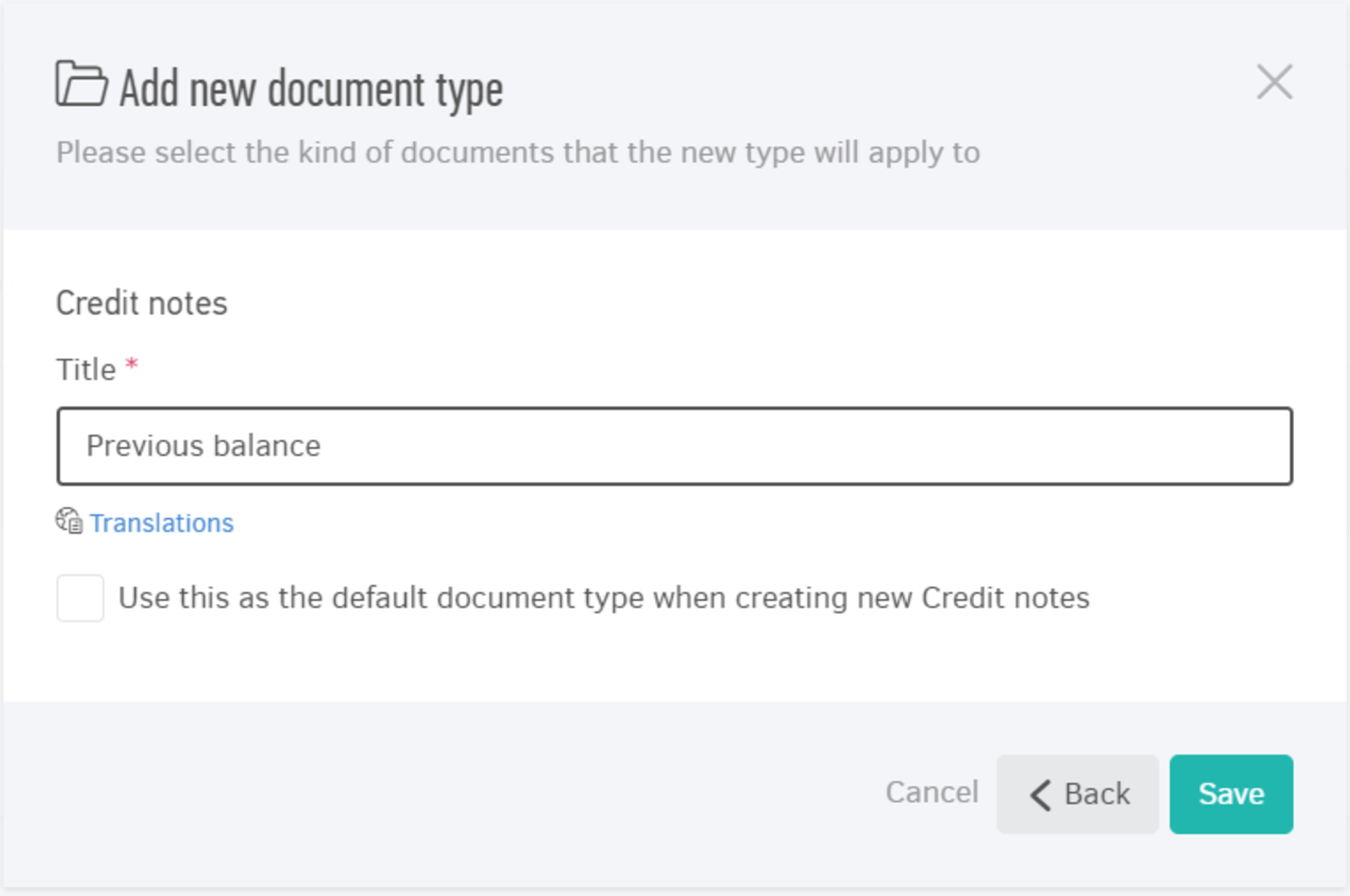

First you should create the related document type through menu Settings-> Document types-> Add and choose the new type to apply to Credit notes.

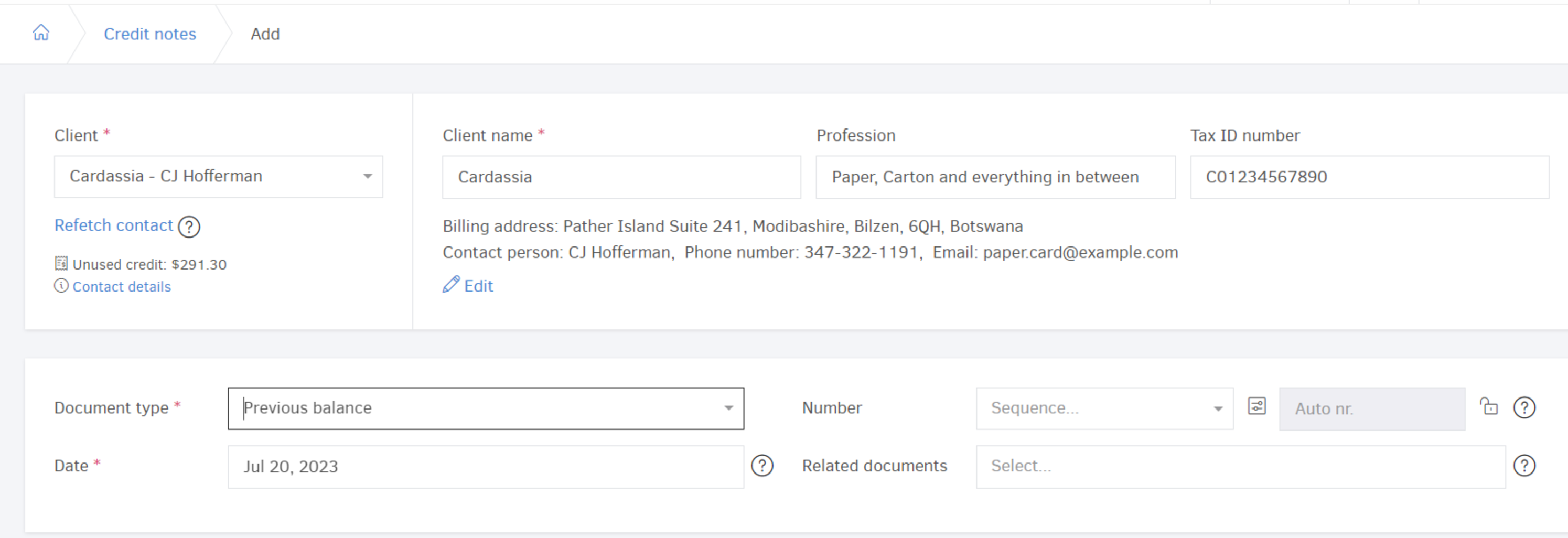

After that, you go to "...More-> Credit notes-> Add".

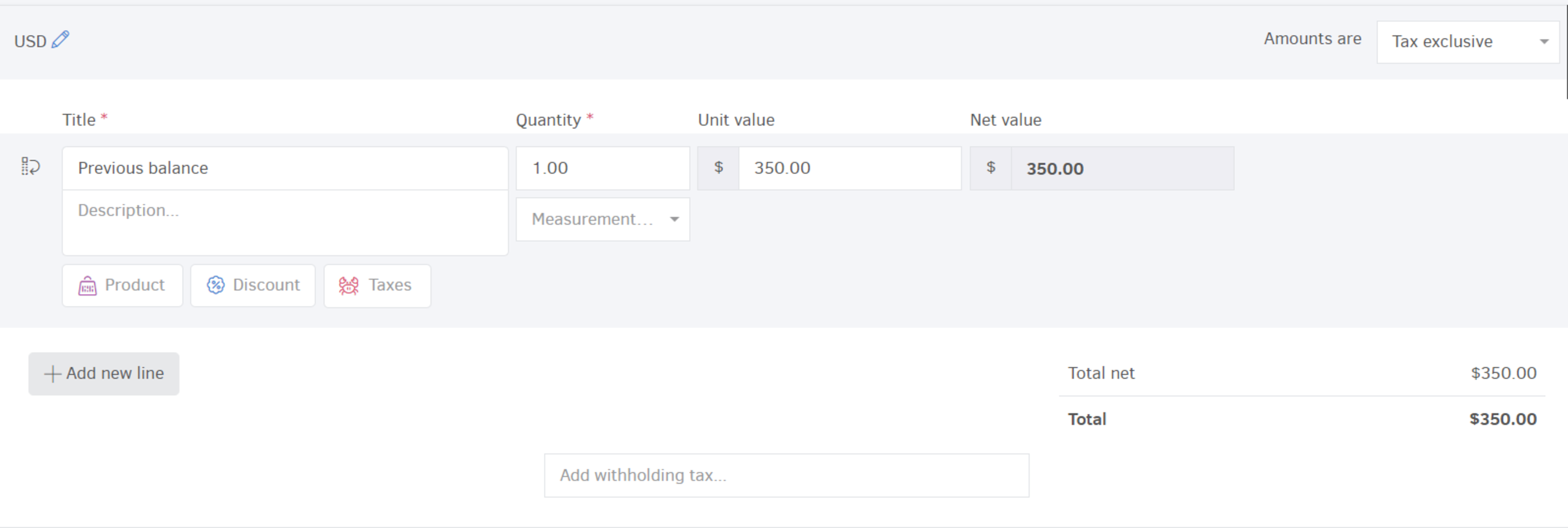

Here, you will select the client and then the "Previous balance" in the "Document Type" field. Proceed with completing the "Products / Services" table by typing something indicative of the transaction in "Title", such as Previous balance.

In the "Unit value" type the amount of the balance, without applying a VAT from the "Taxes" field.

See the example below:

To finalize the record select "Mark as issued" and click "Save". After completing these steps, the client's previous balance will be visible inside the contact's details and statement.

Outstanding balance pay-off

When your company pays off this amount you can register that transaction by making a "New payment" from the credit note's preview page, just like in the case of normal credit notes.

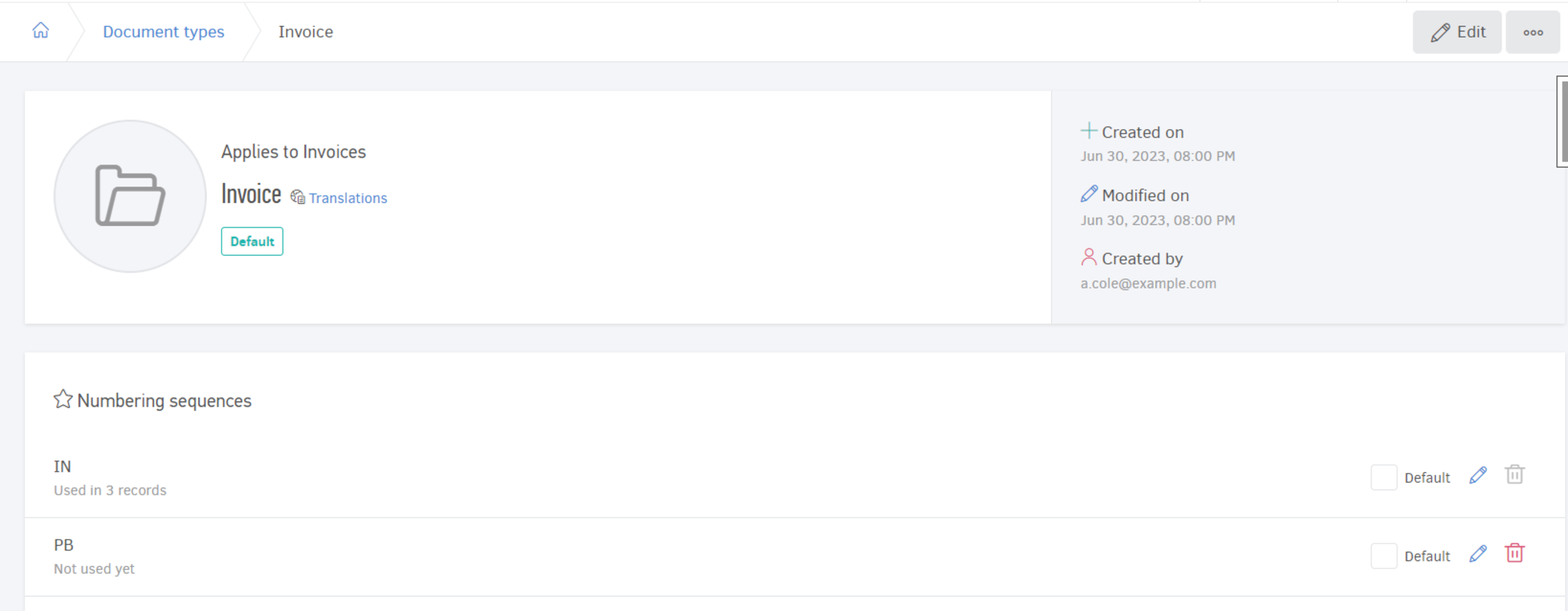

Note: You can create a numbering sequence instead of a document type, if you prefer it. This can be done in Settings-> Document types. You open the document type "Invoice" for example and you enter "PB" (stands for Previous Balance) in the "Sequence name" field.

Previous balances from purchases (suppliers)

To capture suppliers' previous balances you simply need to manually create documents as in the case of sales documents.

There are two possible scenarios here as well; let's see each one in detail:

- Your company owes to the supplier

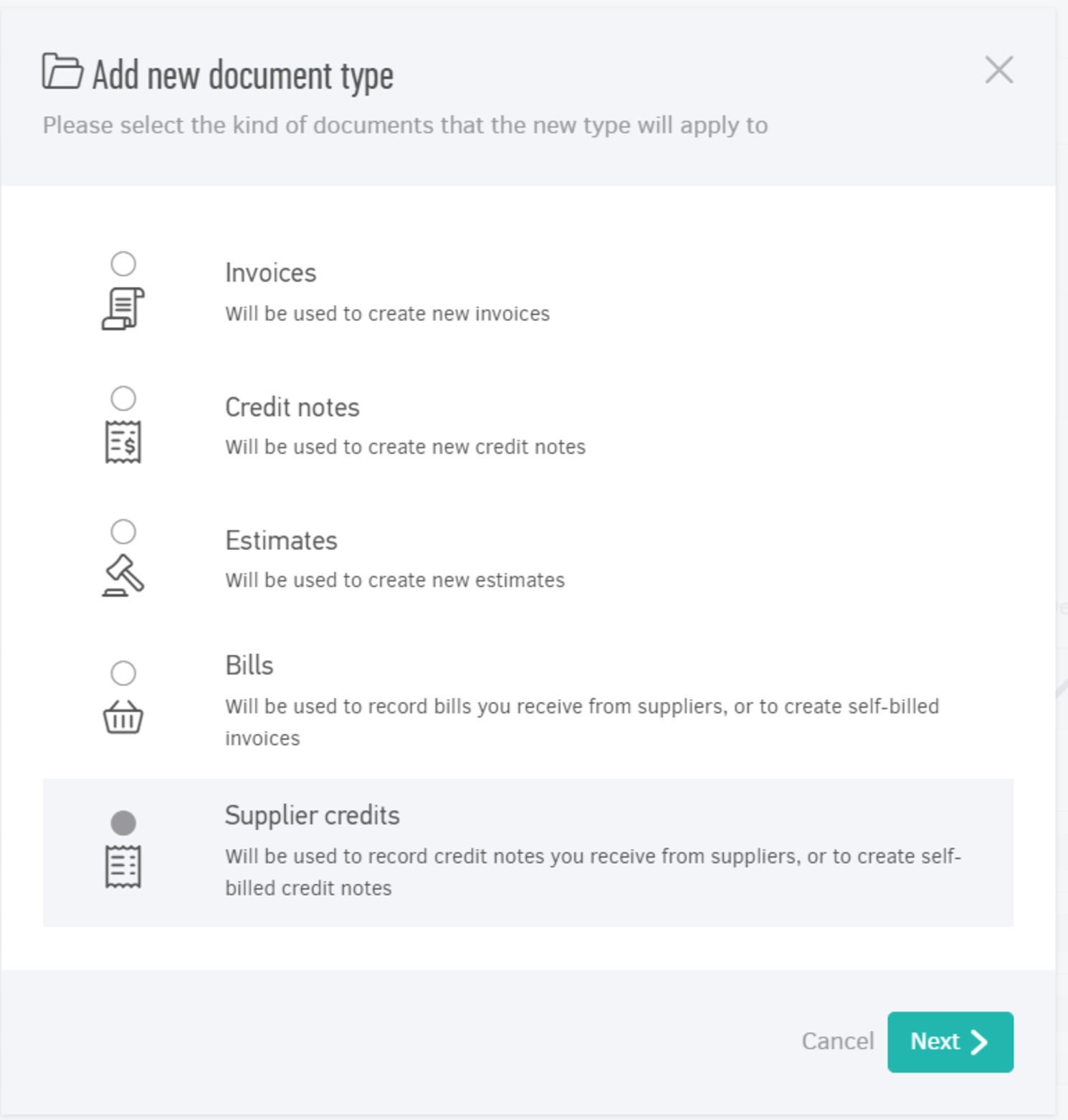

First go to Settings-> Document types-> Add to create the relevant document type as mentioned above.

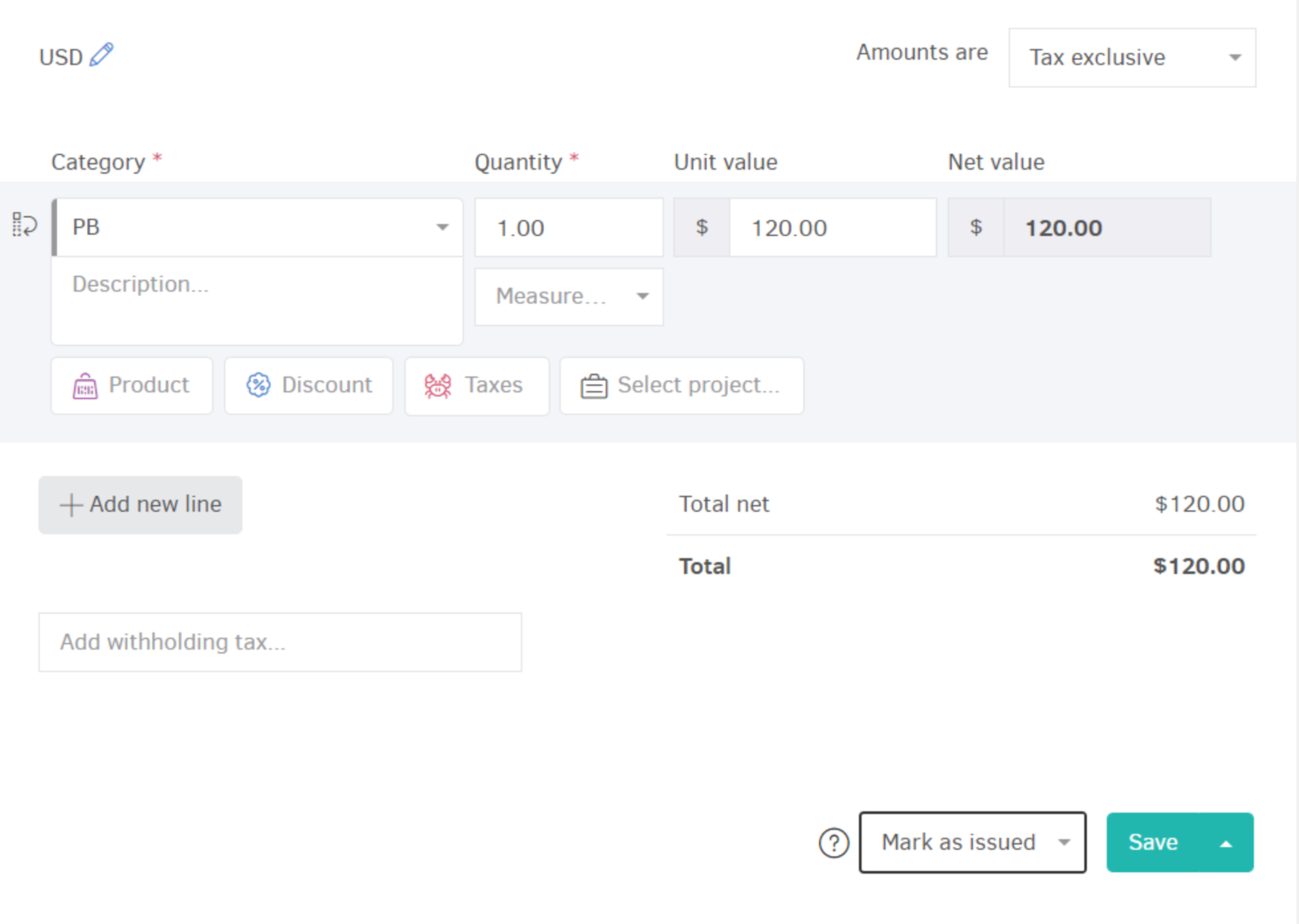

Then go to "...More-> Bills-> Add-> Record a supplier bill" and select the supplier desired. In the "Document type" field choose Previous balance.

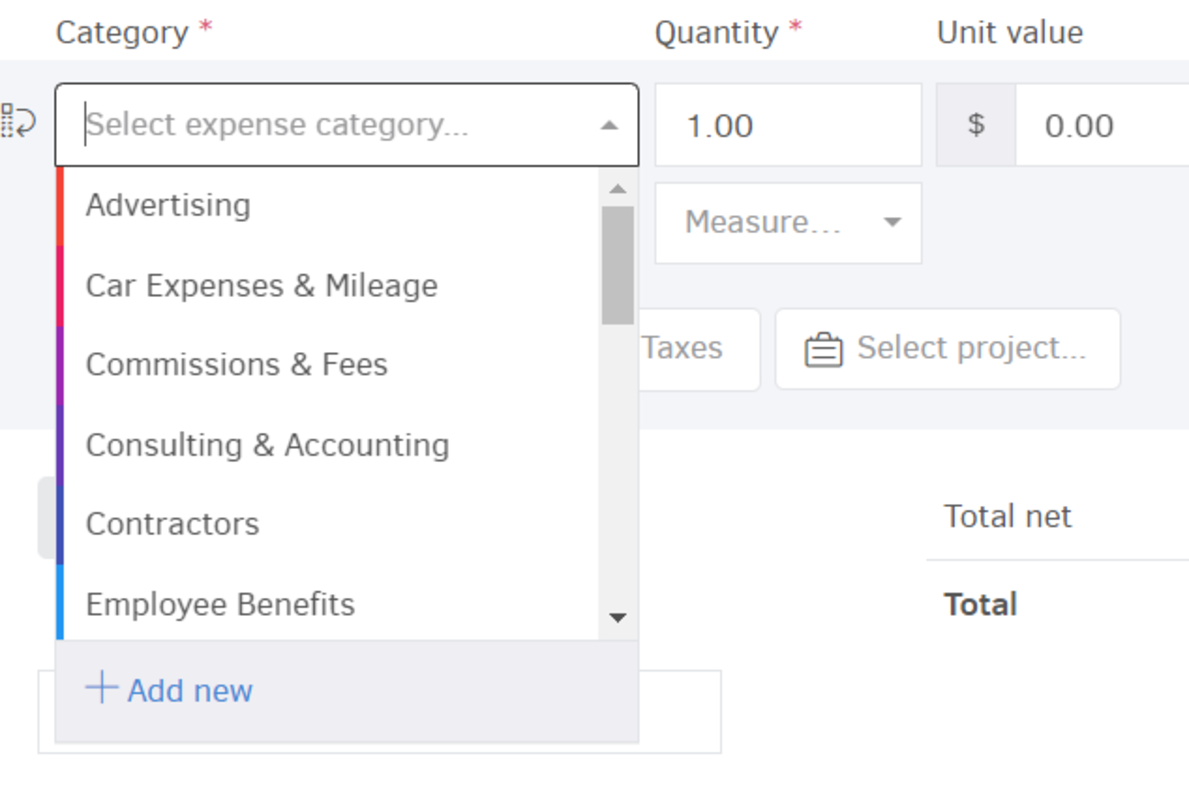

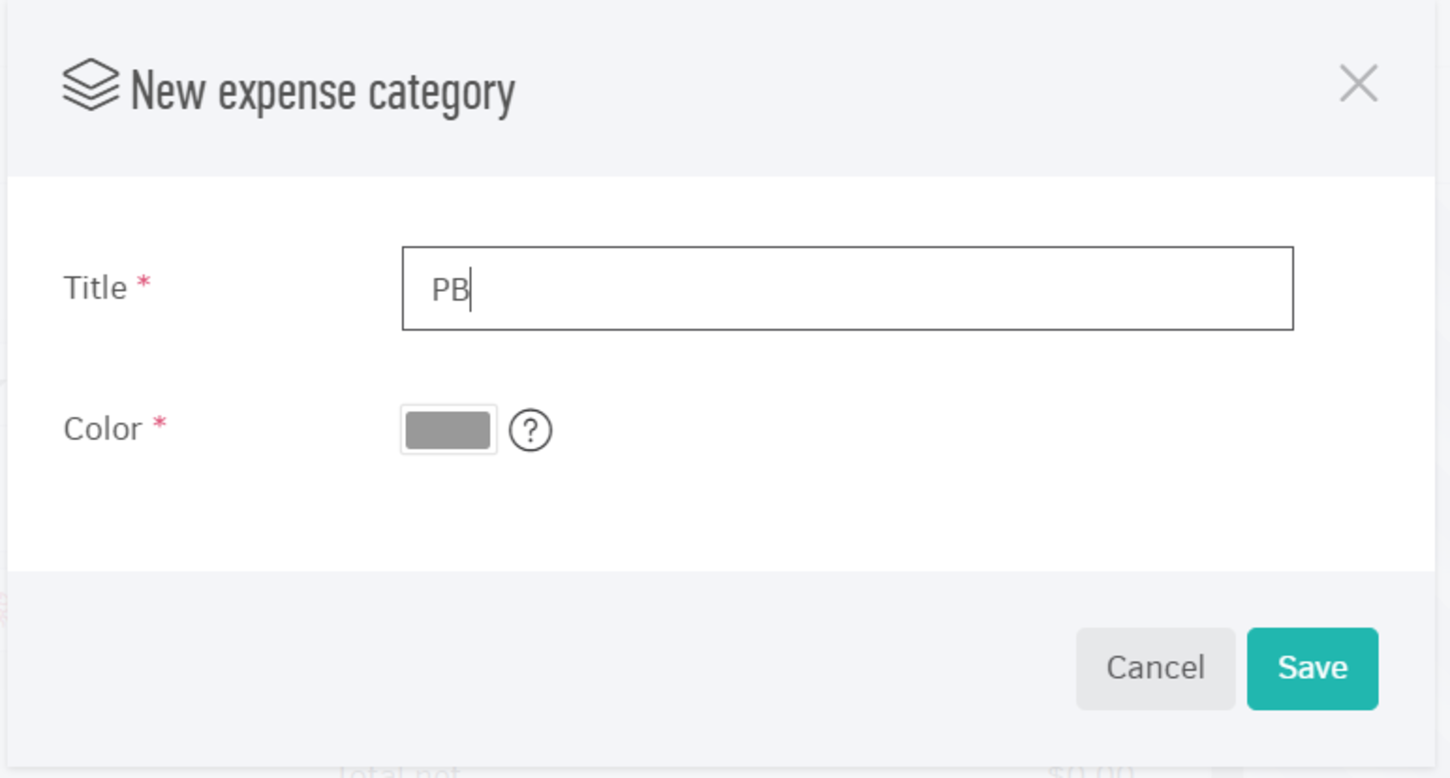

Then, in the "Select expense category" field you can add a new one as seen in the pictures below.

Next, select "Mark as issued" and click "Save" to complete the registration process. After completing these steps, the supplier's previous balance will be visible inside the contact's details and statement.

Outstanding balance pay-off

When your company pays off this amount you can register this transaction by making a "New payment" from the invoice's preview page, just like in the case of normal purchase documents.

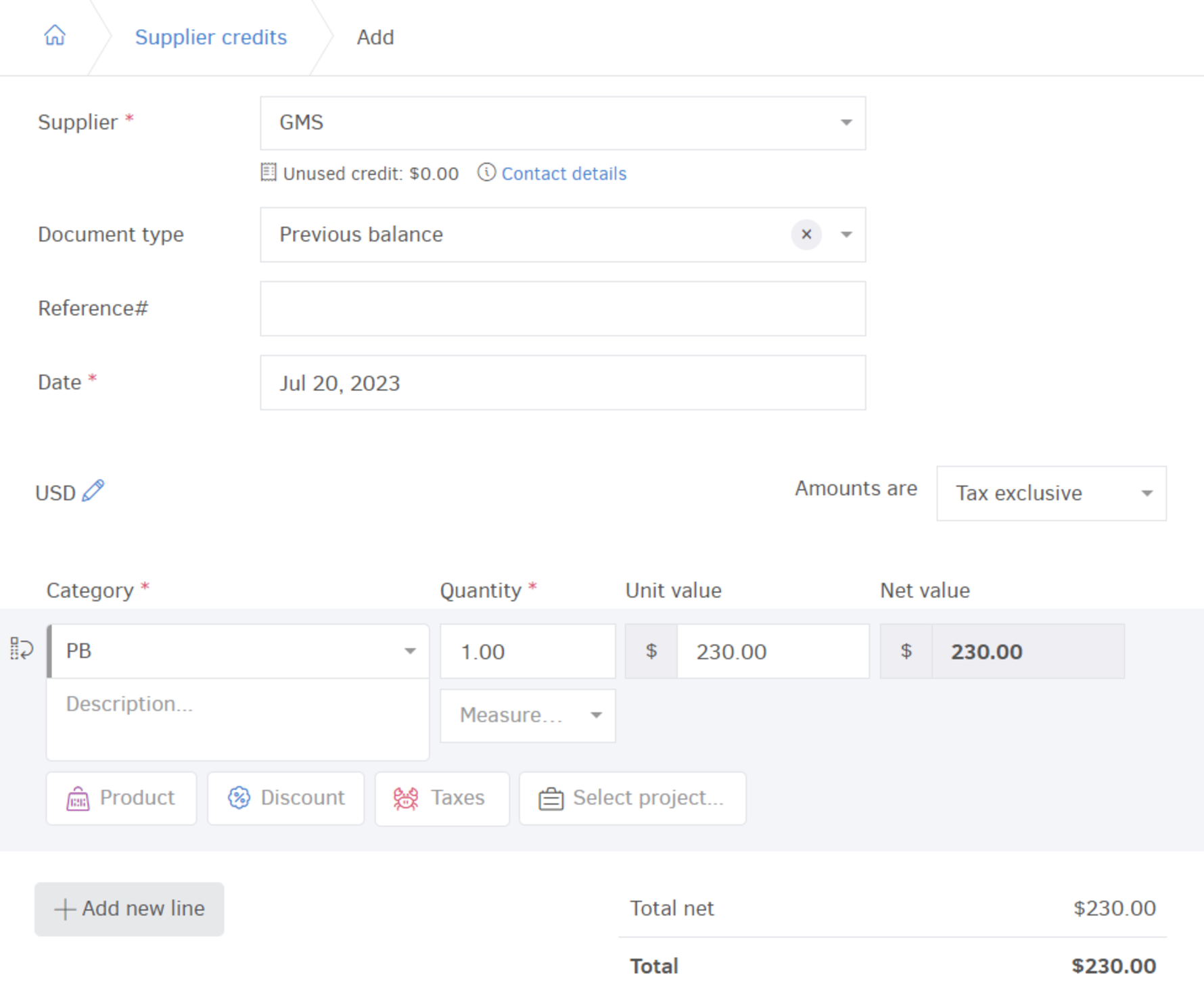

- The supplier owes your company

Then go to ...More-> Supplier credits-> Add-> Record a supplier credit and fill in the fields as seen in the picture below:

Next, select "Mark as issued" and click "Save" to complete the registration process. After completing these steps, the supplier's previous balance will be visible inside the contact's details and statement.

Outstanding balance pay-off

When your supplier pays off this amount you can register that transaction by making a "New payment" from the credit note's preview page, just like in the case of normal purchase credit notes.