As with any other document in Elorus, a credit note can be marked as 'paid' by adding a new 'payment sent'. In this case, however, you may also apply credit to the related invoice and both of the transactions will appear on the client statement. The option you select is determined by whether the related invoice has already been paid by the client or not.

Paying off a credit note

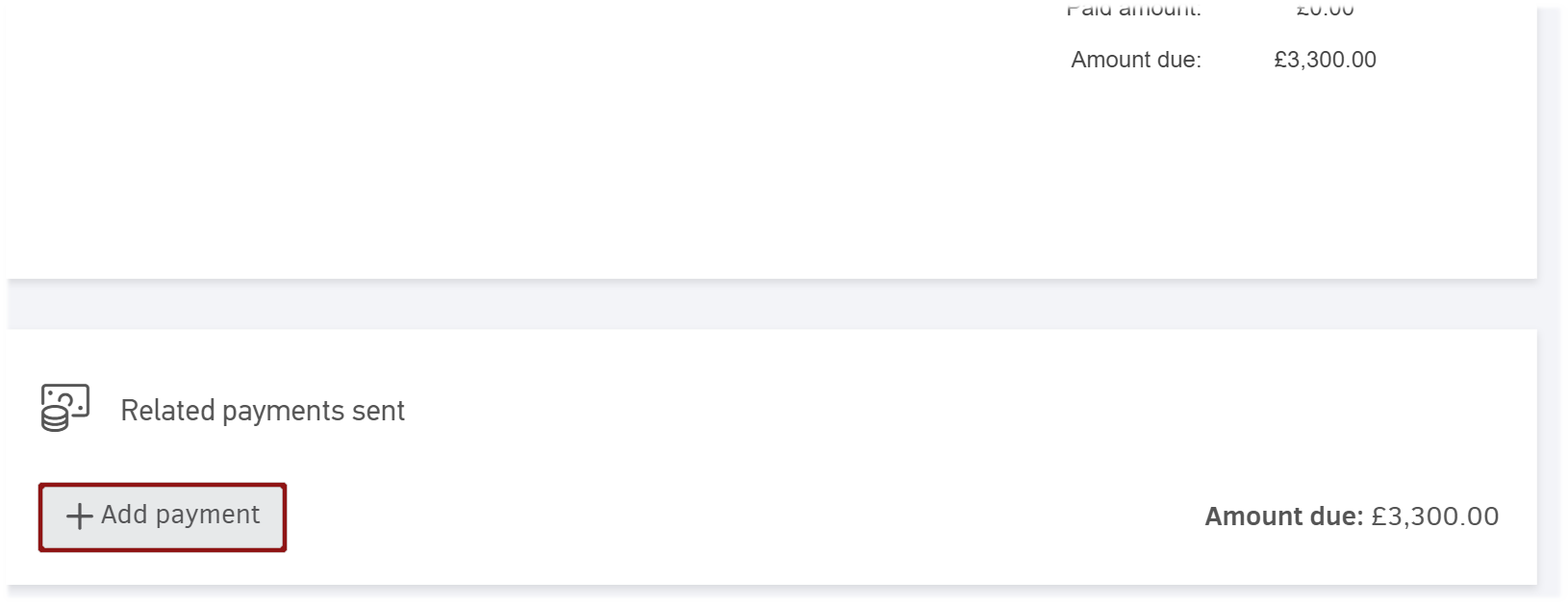

To begin, select the "+Add payment" option on the bottom of the credit note, as shown in the image below:

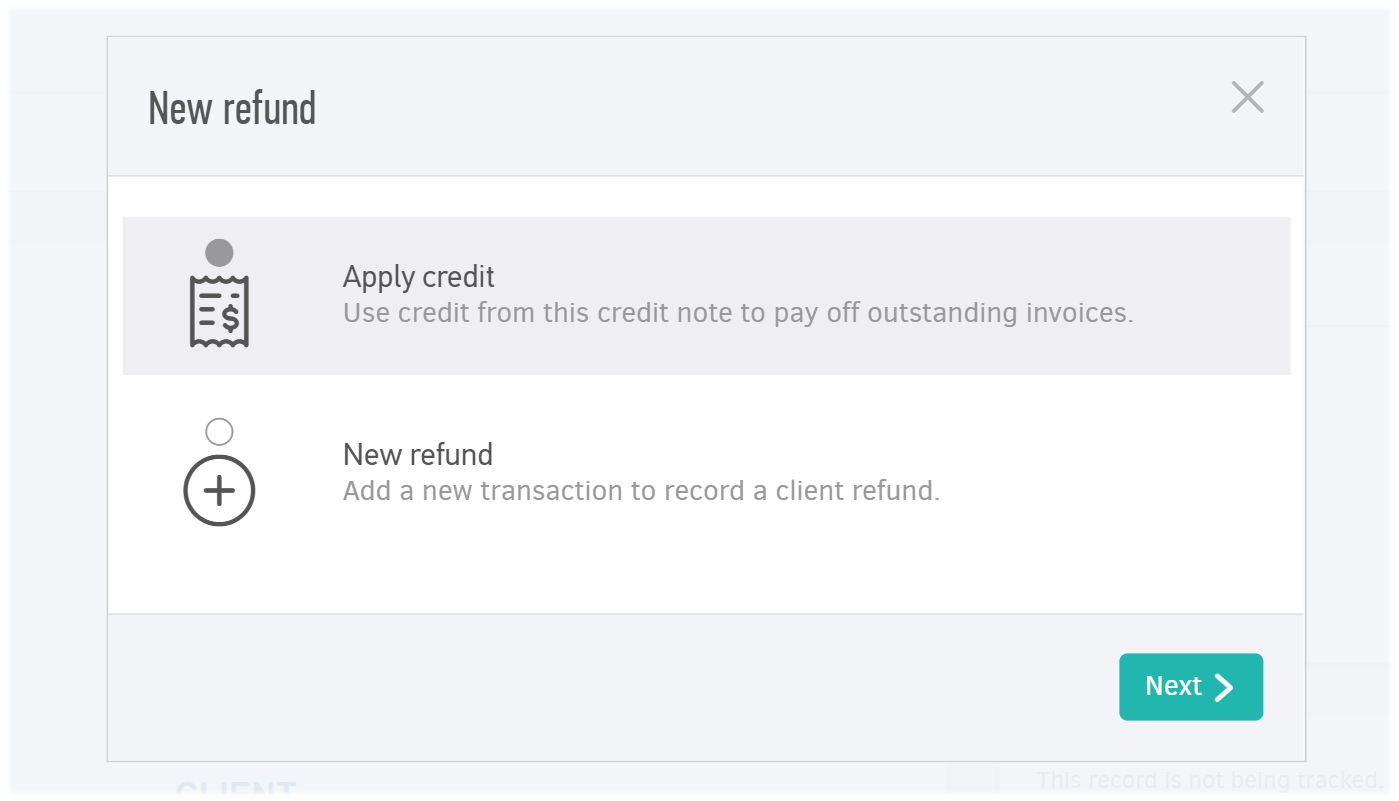

This will make the one of following options appear:

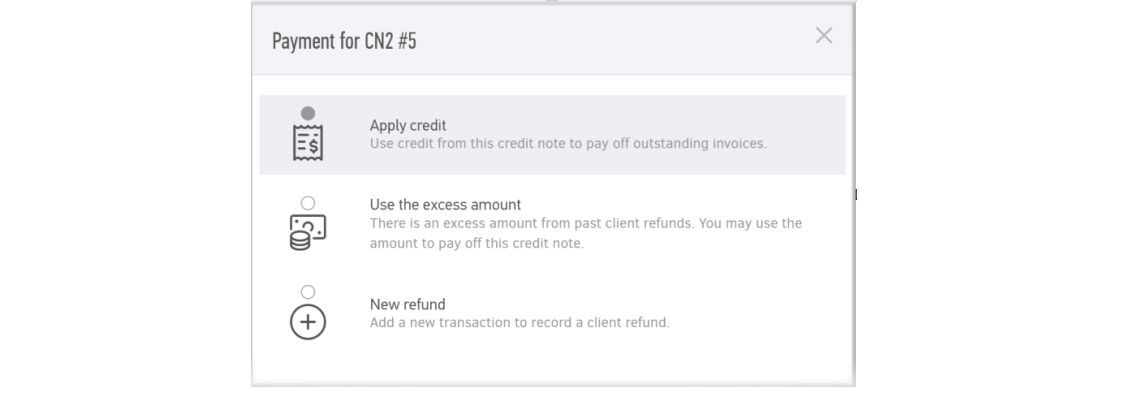

If you have already submitted a payment to your client and the payment can be found under payments sent (as refund), you will get the "use excess amount as well".

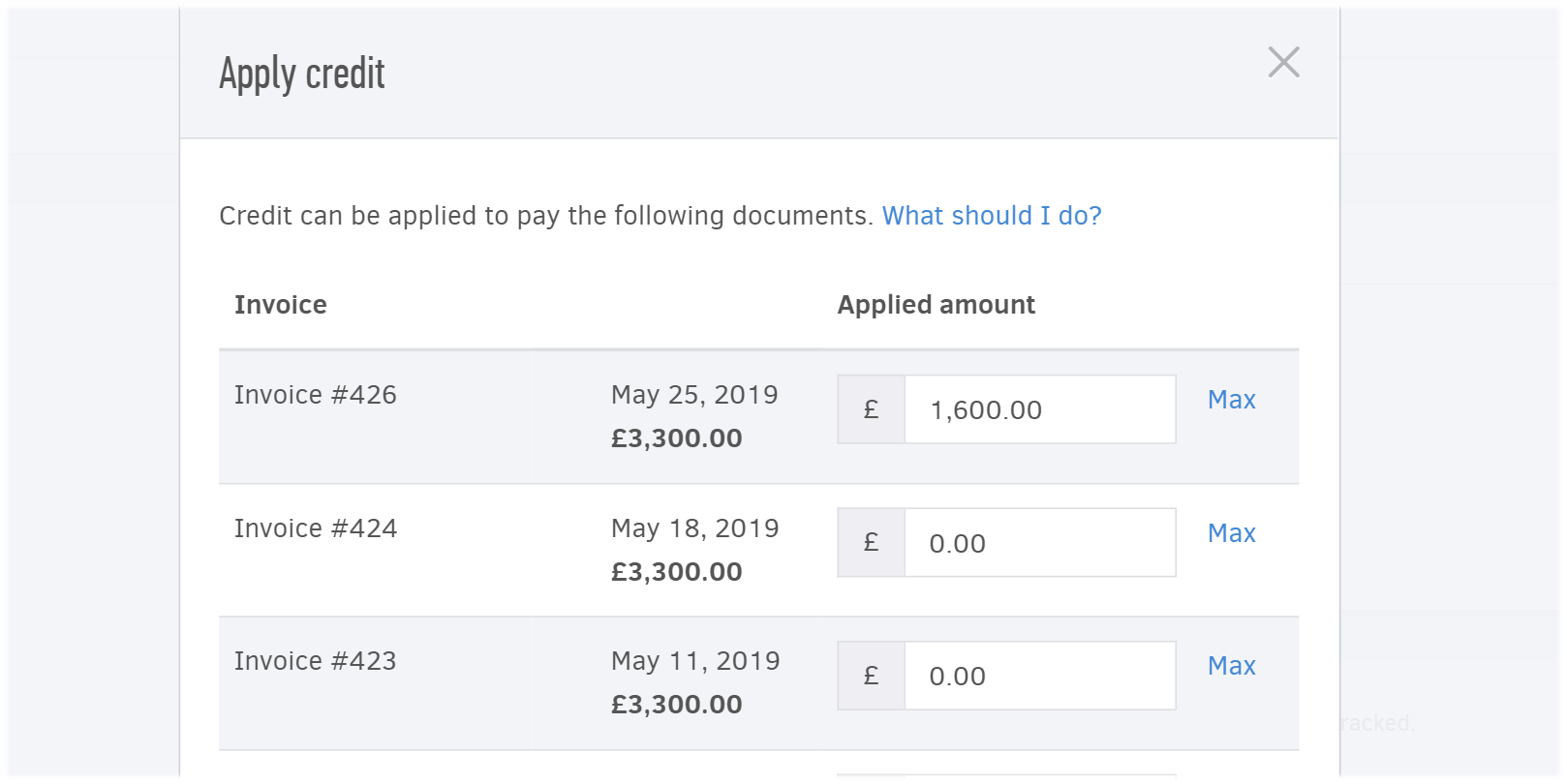

Apply credit

Say that, you have issued the invoice to your client, they received the products and before any payment was completed, they returned them. Therefore, you need to issue a credit note. You have the option of reconciling the amounts of the debit and credit documents by entering a new payment using credit by clicking on the "Apply credit" option.

Note: The credit can be applied either from the related invoice or from the credit note view page.

When you click the option, you have the following window:

In the example, the total amount of the related invoice is £3,300.00. The products to refund, however, are valued at £1,600.00

+New refund (or Use excess amount)

The credit note would need to be paid by 'adding a new refund' in one of these occasions.

-

You created the credit note by opening a 'Paid' invoice and selecting "... (More)-> Create credit note"

-

You navigated to "...More -> Credit notes" and added a credit note to indicate refund, relating it to a paid invoice.

On both of these occasions, the initial document (invoice) indicates that customer already completed the payment of the invoice/returning product before you issued the credit note.

This means you are also returned the amounts you initially received: this payment will be found under "Payments sent" (client refund).

Use excess amount means there is already sufficient amount in the "Payments sent/client refund" section and you will use it, or part of, to mark successful return of goods/cancellation of paid services along with refunding the client for their purchase.

For cases that no payment was completed, you simply select "apply credit" as discussed above.