The setting is available across the application: Invoices, Expenses, Bills are some of the functions that come up with a single or multiple item lines. Each item is added along with its value: initial or total. Elorus will then calculate the tax for each item line, based on the VAT percentage (or other tax) you select. See how to setup a calculator for initial or total value.

Setup a calculator mode for ALL documents

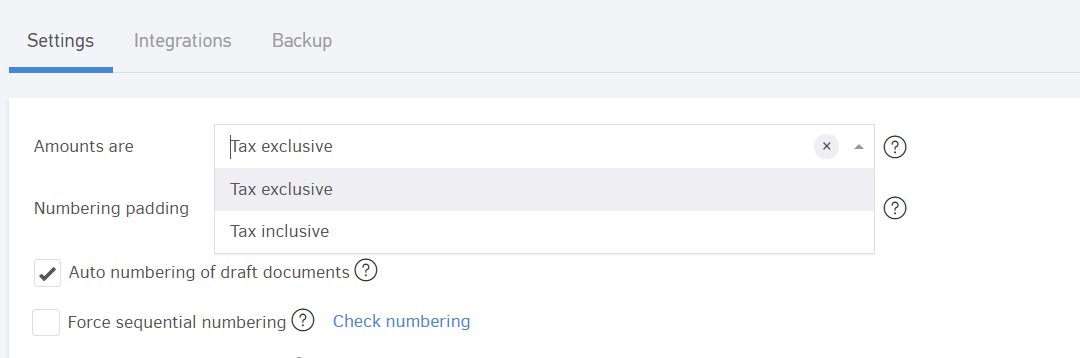

If you want to apply a specific calculation method as default for all of your documents, you can do so from the Settings -> Application settings page.

On the "Amounts are" field, select between totals and initial values (tax inclusive and tax exclusive amounts).

This setting controls how values are calculated and applies to Estimates, Invoices, Bills and Recurring Documents. You can change this for each document individually as you'll see in the next paragraph.

Setup a calculator mode per document

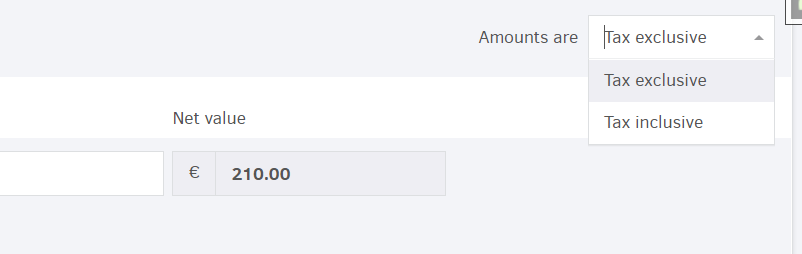

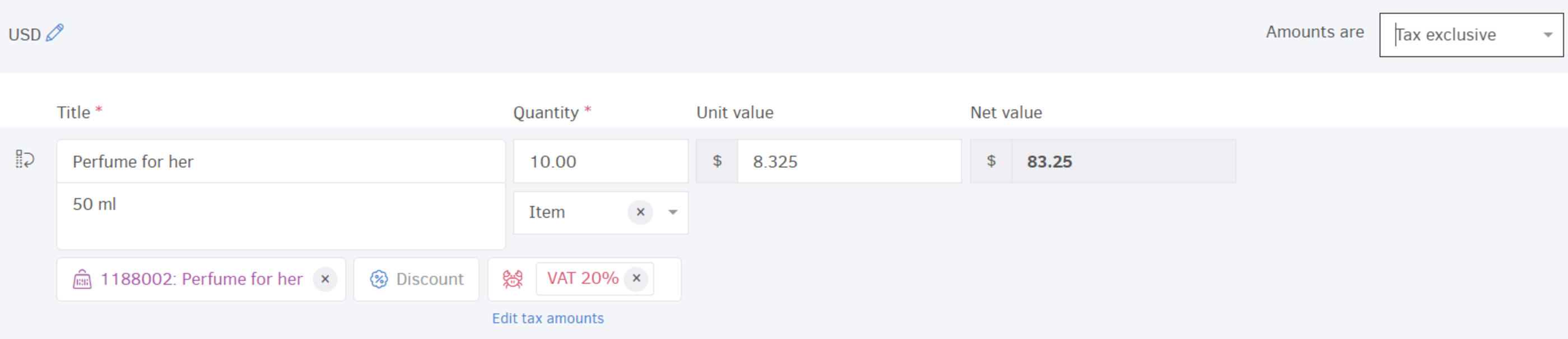

To choose how values are calculated within a specific document, just click the "Amounts are" button, located at the top-right of the Products/Services section when adding/editing.

As an example, initially, we will calculate the values for a document including a single product/service, multiplied by 10, based on the total price and then calculate the values of the document for the same product/service in the same amount, but based on the initial value.

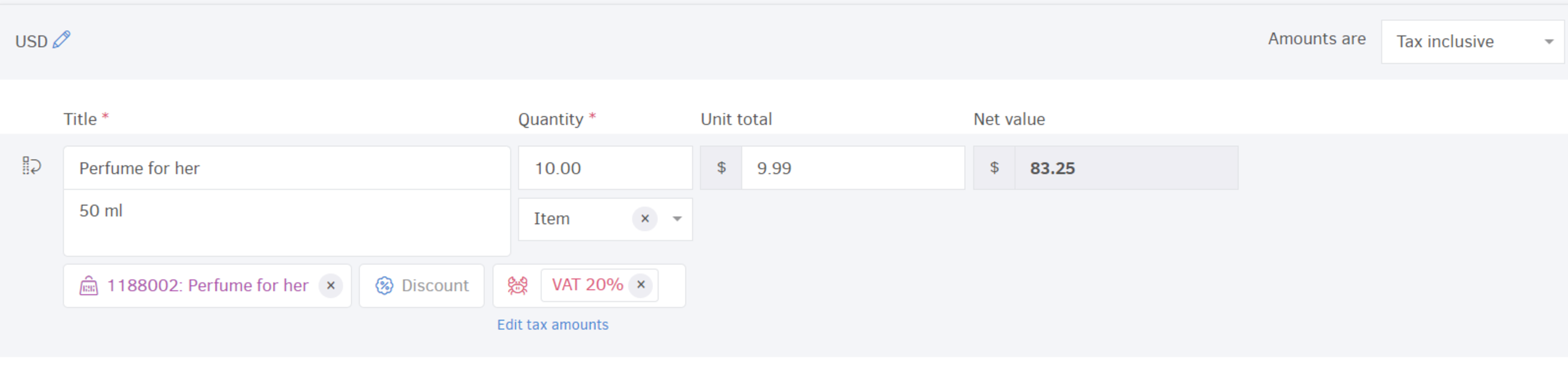

Value calculations based on totals (tax inclusive)

Let us assume that the product’s total value is known, equal to 9,99 and wish to apply a VAT rate of 20%. The value of this particular product/service is displayed on the image below.

Since you wish the product/services quantity to be 10, the total value of the document occurs as follows:

Value calculations based on initial value (tax exclusive)

In the above scenario, values were calculated based on the total values of products/services. In some cases, however, the product/services initial value is known to us.

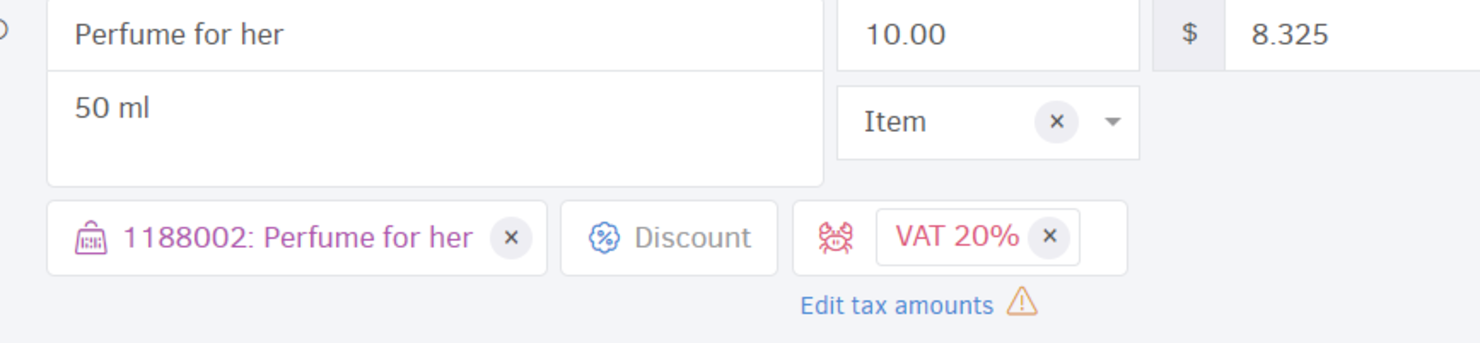

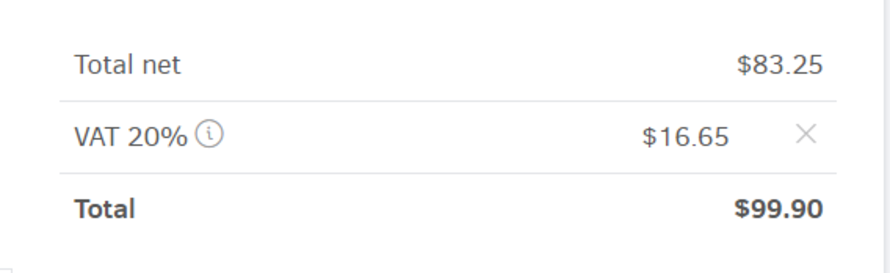

Let us assume you wish to calculate the last document's total amount based on the initial values of product/services. After you select the initial value calculation method, as described above, the new values are automatically calculated into the document. In the image below the new values can be seen as occurred, based on initial value.

The document’s total amount is now calculated as the total initial value of existing products/services (remember that unit's initial value is 8,325), plus taxes.

Custom tax amounts

There are cases (i.e. rounding or other factors) where the tax amounts are different from the ones calculated automatically by the system.

Elorus provides you with a solution to this by allowing you to edit the tax amount. Just click "Edit tax amounts", then uncheck Auto calculate and specify the amount.

Note that you must specify up to 2 decimal places.

Right after you finish editing you can see a symbol below the taxes field which indicates that the line contains custom tax amounts.