Accounting reports are divided into two categories:

- Revenue/Expenses detail

- Tax report

To access these reports, go to Reports from the main menu and select the one you want.

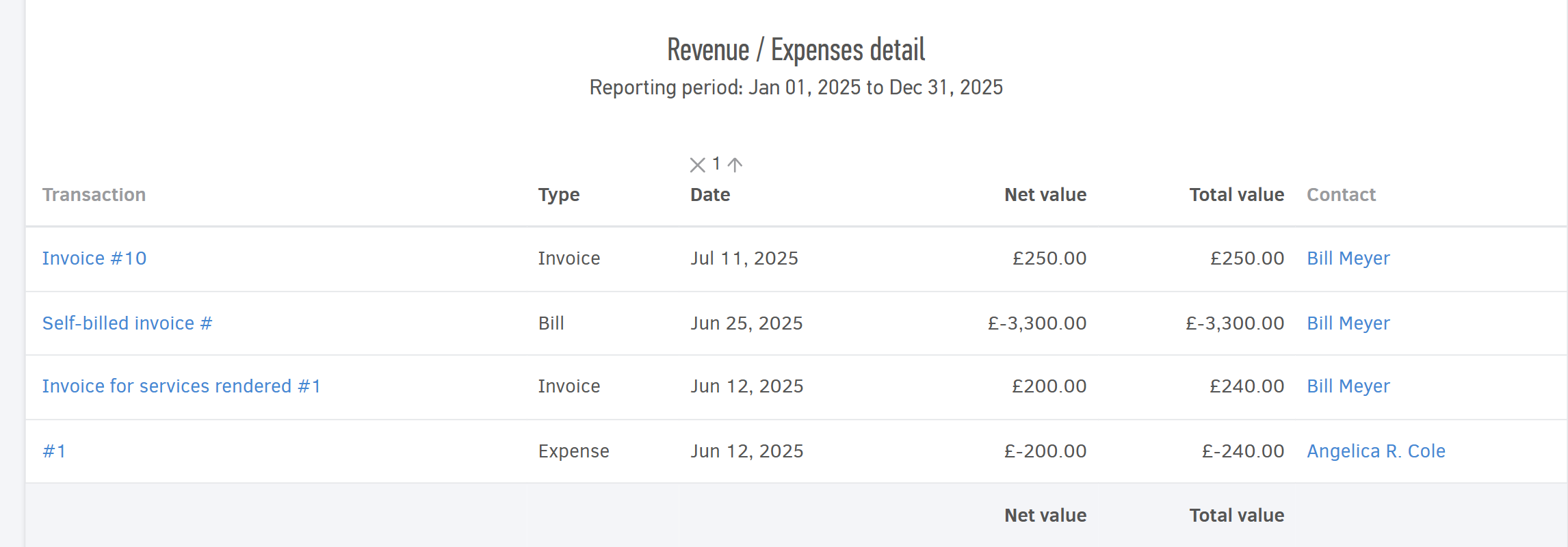

Revenue/Expenses detail

This report includes the total:

-

Income from Sales documents minus sales Credit notes, and Other income (e.g. rental income)

-

Expenses from entries you've added under Expenses and Bills

-

Supplier credit notes (displayed in the report as positive amounts).

Group the report by month, by revenues/expenses or by branch, to get more targeted insights for the selected period.

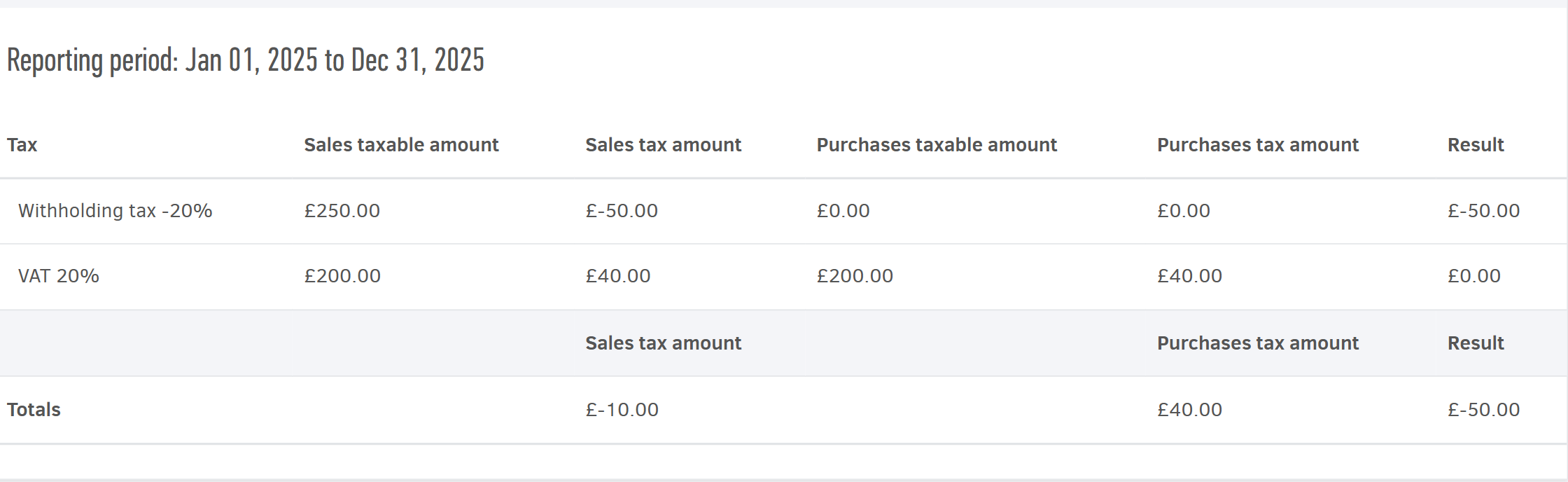

Tax report

This report shows the tax amount related to your business Sales and Purchases.

In the report's horizontal layout, you’ll see detailed information for each tax type:

-

the Sales taxable amount,

-

the Sales tax amount,

-

the Purchases taxable amount,

-

the Purchases tax amount,

-

the Result (sales taxes minus purchase taxes).

The Tax report gives you an initial overview of the taxes arising from your transactions, based on the entries you have recorded in Elorus. Final verification and reconciliation of your business’s input and output taxes should always be carried out by your accountant.